ACCA;

Description

BenchChem offers high-quality ACCA; suitable for many research applications. Different packaging options are available to accommodate customers' requirements. Please inquire for more information about ACCA; including the price, delivery time, and more detailed information at info@benchchem.com.

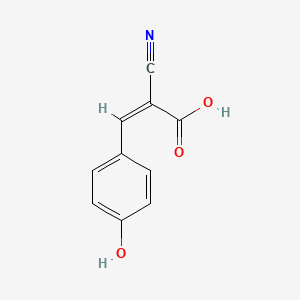

Structure

3D Structure

Propriétés

IUPAC Name |

(Z)-2-cyano-3-(4-hydroxyphenyl)prop-2-enoic acid | |

|---|---|---|

| Details | Computed by Lexichem TK 2.7.0 (PubChem release 2021.05.07) | |

| Source | PubChem | |

| URL | https://pubchem.ncbi.nlm.nih.gov | |

| Description | Data deposited in or computed by PubChem | |

InChI |

InChI=1S/C10H7NO3/c11-6-8(10(13)14)5-7-1-3-9(12)4-2-7/h1-5,12H,(H,13,14)/b8-5- | |

| Details | Computed by InChI 1.0.6 (PubChem release 2021.05.07) | |

| Source | PubChem | |

| URL | https://pubchem.ncbi.nlm.nih.gov | |

| Description | Data deposited in or computed by PubChem | |

InChI Key |

AFVLVVWMAFSXCK-YVMONPNESA-N | |

| Details | Computed by InChI 1.0.6 (PubChem release 2021.05.07) | |

| Source | PubChem | |

| URL | https://pubchem.ncbi.nlm.nih.gov | |

| Description | Data deposited in or computed by PubChem | |

Canonical SMILES |

C1=CC(=CC=C1C=C(C#N)C(=O)O)O | |

| Details | Computed by OEChem 2.3.0 (PubChem release 2021.05.07) | |

| Source | PubChem | |

| URL | https://pubchem.ncbi.nlm.nih.gov | |

| Description | Data deposited in or computed by PubChem | |

Isomeric SMILES |

C1=CC(=CC=C1/C=C(/C#N)\C(=O)O)O | |

| Details | Computed by OEChem 2.3.0 (PubChem release 2021.05.07) | |

| Source | PubChem | |

| URL | https://pubchem.ncbi.nlm.nih.gov | |

| Description | Data deposited in or computed by PubChem | |

Molecular Formula |

C10H7NO3 | |

| Details | Computed by PubChem 2.1 (PubChem release 2021.05.07) | |

| Source | PubChem | |

| URL | https://pubchem.ncbi.nlm.nih.gov | |

| Description | Data deposited in or computed by PubChem | |

Molecular Weight |

189.17 g/mol | |

| Details | Computed by PubChem 2.1 (PubChem release 2021.05.07) | |

| Source | PubChem | |

| URL | https://pubchem.ncbi.nlm.nih.gov | |

| Description | Data deposited in or computed by PubChem | |

CAS No. |

28166-41-8 | |

| Record name | NSC173138 | |

| Source | DTP/NCI | |

| URL | https://dtp.cancer.gov/dtpstandard/servlet/dwindex?searchtype=NSC&outputformat=html&searchlist=173138 | |

| Description | The NCI Development Therapeutics Program (DTP) provides services and resources to the academic and private-sector research communities worldwide to facilitate the discovery and development of new cancer therapeutic agents. | |

| Explanation | Unless otherwise indicated, all text within NCI products is free of copyright and may be reused without our permission. Credit the National Cancer Institute as the source. | |

Foundational & Exploratory

The Strategic Financial Management of Research Laboratories: An In-depth Guide for Scientific and Drug Development Professionals

In the high-stakes environment of scientific research and drug development, where groundbreaking discoveries are the ultimate goal, the meticulous management of financial resources is not merely an administrative task but a cornerstone of operational excellence and long-term success. For researchers, scientists, and drug development professionals, a comprehensive understanding of financial management principles is indispensable for navigating the complexities of funding, resource allocation, and strategic planning. This technical guide provides an in-depth exploration of the critical role of financial management in a research lab, offering detailed methodologies for key financial processes and visualizing complex workflows to enhance comprehension.

Core Pillars of Financial Management in a Research Laboratory

Effective financial management in a research laboratory rests on four key pillars: Budgeting and Financial Planning, Grant and Fund Management, Resource Allocation and Cost Control, and Financial Reporting and Compliance. Each of these functions is interconnected and vital for the fiscal health and scientific productivity of the laboratory.

A laboratory's budget serves as a financial blueprint, outlining anticipated income and expenditures over a specific period.[1][2] It is a proactive tool that enables lab managers to make informed decisions regarding the allocation of resources to achieve research objectives.[1] The three primary components of a typical lab budget are personnel costs, major equipment, and supplies/consumables.[3] Personnel costs, including salaries and benefits, can constitute a significant portion of the budget, often as much as 60%.[4][5] Consumables, such as pipette tips, gloves, and reagents, can account for over 60% of the non-personnel budget.[5][6]

Grant management involves the entire lifecycle of a grant, from identifying funding opportunities and proposal submission to post-award administration and closeout.[7] Successful grant management ensures compliance with the funding agency's terms and conditions and maximizes the use of awarded funds to achieve the proposed research goals.[8]

Resource allocation is the strategic process of assigning available resources, including personnel, equipment, and consumables, to various research projects and activities.[9] Effective resource allocation aims to optimize scientific output while controlling costs. This includes making informed decisions about purchasing new equipment versus utilizing core facilities, and implementing efficient inventory management systems to minimize waste.[10][11]

Financial reporting provides stakeholders, including principal investigators, funding agencies, and institutional administrators, with a clear picture of the laboratory's financial performance.[12][13][14] Timely and accurate financial reports are crucial for demonstrating fiscal responsibility, ensuring compliance with reporting requirements, and informing future financial planning.[12][13][14]

Data-Driven Financial Planning: A Quantitative Overview

To effectively manage a research laboratory's finances, it is essential to understand the typical distribution of costs and the landscape of research funding. The following tables provide a summary of key quantitative data to aid in financial planning and decision-making.

| Expense Category | Typical Percentage of Budget | Notes |

| Personnel Costs | 50% - 60% | Includes salaries, fringe benefits for PIs, postdoctoral researchers, graduate students, and technicians. This is often the largest portion of a lab's budget.[3][4][5] |

| Consumables & Supplies | 20% - 30% | Includes reagents, chemicals, pipette tips, gloves, and other disposable items. A significant recurring expense.[3][5][6] |

| Equipment (Purchase & Maintenance) | 10% - 15% | Includes the cost of new equipment, service contracts, and repairs. Can be a major capital expenditure. |

| Travel | 2% - 5% | For attending conferences, workshops, and collaborative meetings. |

| Indirect Costs (Overhead) | Varies by institution | Costs not directly tied to a specific project but necessary for lab operations (e.g., utilities, administrative support). Rates are negotiated with funding agencies.[15][16] |

| Table 1: Typical Allocation of a Research Laboratory Budget. This table presents a generalized breakdown of expenses. The exact percentages can vary significantly based on the type of research, the size of the lab, and the specific projects underway. |

| Funder/Grant Type | 2022 Success Rate | 2023 Success Rate | Average Award Size (2023) |

| NIH Research Project Grants (RPGs) | 20.7% | Increased by 2.8% from FY22 | Increased by 2.9% from FY22 |

| NIH R01-Equivalent Grants | 21.6% | Increased by 0.3% from FY22 | Increased by 2.7% from FY22 |

| Table 2: National Institutes of Health (NIH) Grant Funding Success Rates and Award Sizes. Success rates for NIH grants are highly competitive and fluctuate annually.[17][18] Understanding these trends is crucial for strategic grant application planning. |

| Technology/Strategy | Potential Financial Impact | Key Benefits |

| Laboratory Automation | Significant long-term cost savings. | Reduces labor costs, minimizes human error, increases throughput, and allows for 24/7 operation.[19][20][21][22] |

| Inventory Management Systems | Reduction in supply waste by up to 75%. | Optimizes stock levels, eliminates emergency orders, reduces waste from expired reagents, and saves staff time.[11][23][24] |

| Procurement Software | Reduces time scientists spend on procurement by up to 8 hours a week. | Streamlines purchasing workflows, enforces compliance with approved vendors, and provides real-time budget tracking.[1][25][26] |

| Table 3: Financial Impact of Key Management Strategies. Implementing modern laboratory management technologies and strategies can lead to substantial cost savings and increased operational efficiency. |

Experimental Protocols for Core Financial Management Processes

To ensure consistency, transparency, and efficiency in financial operations, it is beneficial to establish standardized protocols for key processes. The following sections provide detailed, step-by-step methodologies for creating a laboratory budget, managing research grants, and executing the procurement of supplies and equipment.

Protocol 1: Laboratory Budget Creation

Objective: To develop a comprehensive and realistic budget that aligns with the laboratory's research goals and available funding.

Methodology:

-

Define Research Objectives and Scope: Clearly outline the research projects and specific aims for the budget period.[15]

-

Identify and Categorize All Potential Expenses: Create a detailed list of all anticipated costs and group them into logical categories such as personnel, equipment, consumables, travel, and indirect costs.[3][4]

-

Estimate Personnel Costs:

-

List all current and planned personnel.

-

Determine the gross salary for each individual.

-

Calculate associated fringe benefit costs (e.g., health insurance, retirement contributions) based on institutional rates.[4]

-

-

Quantify Consumable and Supply Needs:

-

For each research project, list all necessary reagents, kits, and other consumables.

-

Estimate the quantity of each item needed for the budget period.

-

Obtain price quotes from vendors, considering bulk discounts for frequently used items.[6]

-

-

Assess Equipment Needs:

-

Identify any new equipment required to meet research objectives.

-

Obtain quotes from multiple vendors.

-

Include costs for installation, training, and service contracts.

-

Factor in annual maintenance and repair costs for existing equipment.

-

-

Project Travel and Other Direct Costs:

-

Estimate costs for conference attendance, including registration, airfare, and accommodation.

-

Include other direct costs such as publication fees, software licenses, and animal care costs.

-

-

Calculate Indirect Costs (Overhead):

-

Review and Refine:

-

Sum all direct and indirect costs to determine the total budget.

-

Compare the total budget to anticipated funding.

-

Review the budget with the Principal Investigator and other key lab members to ensure it is realistic and comprehensive.

-

Make adjustments as necessary to align expenses with funding.

-

Protocol 2: Research Grant Management

Objective: To effectively manage grant funds in compliance with sponsor regulations and to ensure the timely completion of research objectives.

Methodology:

-

Post-Award Review:

-

Thoroughly review the notice of award and the sponsor's terms and conditions.[8]

-

Identify key personnel, reporting deadlines, and any restrictions on spending.

-

-

Budget Allocation and Setup:

-

Work with the institution's sponsored programs office to set up a dedicated account for the grant.

-

Allocate the awarded funds to the budget categories outlined in the proposal.

-

-

Expenditure Monitoring:

-

Regularly track all expenditures against the grant budget using institutional financial systems.[8]

-

Ensure that all costs charged to the grant are allowable, allocable, and reasonable.

-

Maintain detailed documentation for all expenses, including invoices and receipts.

-

-

Personnel Effort Certification:

-

Ensure that salary charges to the grant accurately reflect the effort expended by personnel on the project.

-

Complete and submit effort certification reports as required by the institution.

-

-

Subaward Management (if applicable):

-

If collaborating with other institutions, establish a formal subaward agreement.

-

Monitor the subrecipient's progress and expenditures.

-

Review and approve all invoices from the subrecipient.

-

-

Reporting:

-

Grant Closeout:

-

At the end of the project period, ensure that all financial obligations have been met.

-

Submit a final financial report and any other required closeout documentation to the sponsor.[14]

-

Protocol 3: Procurement of Laboratory Supplies and Equipment

Objective: To acquire necessary supplies and equipment in a timely and cost-effective manner while ensuring compliance with institutional purchasing policies.

Methodology:

-

Identify Need and Specify Requirements:

-

The researcher identifies the need for a specific supply or piece of equipment.

-

Detailed specifications, including catalog numbers, quantities, and any compatibility requirements, are documented.

-

-

Vendor Selection and Quotation:

-

Identify potential vendors. For standard supplies, this may be a preferred institutional supplier.

-

For major equipment purchases, obtain quotes from multiple vendors to ensure competitive pricing.[3]

-

-

Create and Submit Purchase Requisition:

-

Complete an electronic or paper-based purchase requisition form.

-

Include a clear description of the item, quantity, estimated cost, and the funding source to be charged.

-

-

Institutional Approval Workflow:

-

The purchase requisition is routed electronically for necessary approvals. This may include the Principal Investigator, departmental administrator, and the purchasing department.

-

-

Purchase Order Generation:

-

Once all approvals are obtained, the purchasing department issues a formal purchase order to the selected vendor.

-

-

Order Placement and Tracking:

-

The vendor confirms receipt of the purchase order and provides an estimated delivery date.

-

The lab manager or designated personnel can track the status of the order.

-

-

Receipt and Inspection of Goods:

-

Upon delivery, the items are inspected to ensure they match the purchase order and are not damaged.

-

The packing slip is signed and retained.

-

-

Invoice Processing and Payment:

-

The vendor submits an invoice to the institution's accounts payable department.

-

Accounts payable matches the invoice to the purchase order and packing slip.

-

Once verified, payment is issued to the vendor.

-

Visualizing Financial Management Workflows

To further elucidate the intricate processes involved in laboratory financial management, the following diagrams, created using the Graphviz DOT language, illustrate key workflows.

References

- 1. procuredesk.com [procuredesk.com]

- 2. nwtresearch.com [nwtresearch.com]

- 3. Budget Planning | Lab Manager [labmanager.com]

- 4. experimental-designs.com [experimental-designs.com]

- 5. Tips for Managing Your Lab Budget | Fisher Scientific [fishersci.com]

- 6. goldbio.com [goldbio.com]

- 7. opengrants.io [opengrants.io]

- 8. 5 essential steps to manage your research funds effectively | Researcher.Life [researcher.life]

- 9. Cost effectiveness of computerized laboratory automation | IEEE Journals & Magazine | IEEE Xplore [ieeexplore.ieee.org]

- 10. needle.tube [needle.tube]

- 11. safetyculture.com [safetyculture.com]

- 12. Financial Reporting to Sponsors | Cornell Research Services [researchservices.cornell.edu]

- 13. Financial Reporting & Invoicing | HMS Office of Research Administration (ORA) [researchadmin.hms.harvard.edu]

- 14. research.rutgers.edu [research.rutgers.edu]

- 15. dcu.ie [dcu.ie]

- 16. fin-alexander-ostrovskiy.co.uk [fin-alexander-ostrovskiy.co.uk]

- 17. bouviergrant.com [bouviergrant.com]

- 18. bouviergrant.com [bouviergrant.com]

- 19. Cost-Benefit Analysis of Laboratory Automation [wakoautomation.com]

- 20. Economic Evaluation of Total Laboratory Automation in the Clinical Laboratory of a Tertiary Care Hospital - PMC [pmc.ncbi.nlm.nih.gov]

- 21. What Are the Benefits of Laboratory Automation? - Raykol Group (XiaMen) Corp., Ltd. [raykolgroup.com]

- 22. hudsonlabautomation.com [hudsonlabautomation.com]

- 23. labsymplified.com [labsymplified.com]

- 24. scnsoft.com [scnsoft.com]

- 25. Optimizing Lab Procurement: Best Practices and Insights | Lab Manager [labmanager.com]

- 26. go.zageno.com [go.zageno.com]

- 27. Financial Reporting Timeline | Division of Research | Brown University [division-research.brown.edu]

- 28. Financial Reporting Requirements - University of Galway [universityofgalway.ie]

A Technical Guide to Financial Compliance for Scientific Grants

For Researchers, Scientists, and Drug Development Professionals

Navigating the complexities of financial compliance is a critical component of managing scientific grants. Adherence to the financial regulations set forth by funding agencies is not merely an administrative task; it is a cornerstone of responsible research conduct that ensures the integrity and accountability of the work being performed. This in-depth guide provides a technical overview of the core principles of financial compliance for scientific grants, with a focus on the practical application of these principles in a research setting.

The financial administration of a scientific grant is governed by a hierarchy of regulations, beginning with federal-level mandates such as the Uniform Guidance (2 CFR Part 200) in the United States, which establishes the fundamental principles for managing federal awards.[1][2] Funding agencies like the National Institutes of Health (NIH) and European programs such as Horizon Europe build upon these foundational principles with their own specific policies and reporting requirements.[3][4][5][6] Researchers must also be cognizant of their own institution's policies, which often provide an additional layer of procedural guidance.[7][8]

This guide will walk you through the lifecycle of a grant from a financial compliance perspective, from the initial budget preparation to the final project closeout. It will provide detailed methodologies for key processes, summarize quantitative data in easily digestible tables, and use visualizations to clarify complex workflows and relationships.

I. The Grant Lifecycle: A Financial Compliance Perspective

The financial management of a research grant can be conceptualized as a continuous cycle with distinct phases, each with its own set of compliance requirements. Understanding this lifecycle is the first step toward effective financial stewardship.

Core Principles of Cost Allowability

A central tenet of financial compliance for scientific grants is the concept of allowable costs . For a cost to be charged to a grant, it must be:

-

Reasonable: The cost must be one that a prudent person would incur under the circumstances.[1][9]

-

Allocable: The cost must be directly beneficial and assignable to the specific grant.[1][9]

-

Consistently Treated: Costs must be treated consistently across all institutional activities.

-

Compliant with Limitations: The cost must conform to any limitations or exclusions set forth in the funding agreement or federal regulations.[2]

The following diagram illustrates the decision-making process for determining if a cost is allowable.

Table 1: Common Allowable and Unallowable Costs on Federal Grants

The following table summarizes common cost categories and their general allowability on federal research grants. Note that specific funding opportunity announcements or award terms may have exceptions.

| Cost Category | Allowable | Generally Unallowable | Key Considerations |

| Personnel Salaries & Wages | Yes | No | Must be for effort directly related to the grant.[10] |

| Fringe Benefits | Yes | No | Must be in accordance with established institutional policies. |

| Equipment | Yes | No | General-purpose equipment is typically unallowable.[10] |

| Travel | Yes | No | Must be for project-related activities.[11] Dependent travel is generally unallowable.[11] |

| Materials & Supplies | Yes | No | Must be directly consumed in the performance of the research. |

| Publication Costs | Yes | No | Includes costs for printing, distribution, and page charges.[11] |

| Consultant Services | Yes | No | Fees and travel expenses are generally allowable.[11] |

| Subawards | Yes | No | Requires robust subrecipient monitoring.[12][13] |

| Participant Support Costs | Yes | No | Must be for items such as stipends or travel for participants in a research study. |

| Entertainment Costs | No | Yes | Costs for amusement, diversion, and social activities are unallowable.[10][11] |

| Alcoholic Beverages | No | Yes | Unallowable on federal grants.[2][10] |

| Alumni Activities | No | Yes | Costs incurred for alumni relations are unallowable.[10] |

| Fundraising Costs | No | Yes | Costs associated with fundraising are unallowable.[10] |

| Lobbying Costs | No | Yes | Generally unallowable.[10] |

Methodologies for Key Compliance Activities

Budget Preparation

A well-constructed and justified budget is the foundation of financial compliance.[14][15]

Protocol for Compliant Budget Development:

-

Review Funder Guidelines: Thoroughly read the funding opportunity announcement for specific budget limitations, required forms, and cost category definitions.[14]

-

Categorize Direct Costs: Identify all direct costs necessary to complete the project, such as personnel, equipment, travel, and supplies.[14]

-

Calculate Personnel Costs: For each individual, determine the percentage of effort they will dedicate to the project and calculate the corresponding salary and fringe benefits.[16]

-

Itemize and Justify Equipment: List each piece of equipment with a value above the institutional or federal threshold and provide a clear justification for its necessity.

-

Estimate Travel Expenses: Detail the purpose of the travel, the destination, the number of travelers, and the estimated costs for transportation, lodging, and per diem.[17]

-

Quantify Materials and Supplies: Provide a detailed breakdown of consumable materials and supplies, justifying the quantities based on the experimental plan.

-

Calculate Facilities and Administrative (F&A) Costs: Apply the institution's negotiated indirect cost rate to the appropriate direct cost base. F&A costs are generally not allowable on conference grants.[11][18]

-

Write a Detailed Budget Justification: For each cost category, provide a narrative that explains how the costs were calculated and why they are necessary for the project.[14]

Effort Reporting

Effort reporting is the process of certifying that the salaries charged to a sponsored project are a reasonable reflection of the effort expended on that project.[19][20][21]

Protocol for Accurate Effort Reporting:

-

Understand 100% Effort: "100% effort" is defined as the total professional activity for which an individual is compensated by their institution, regardless of the number of hours worked.[20][22]

-

Regular Certification: Effort reports are typically generated and certified on a regular schedule, such as semi-annually or quarterly.[19][21]

-

Certification by Knowledgeable Individuals: The effort report must be certified by the individual or a person with direct knowledge of the work performed, such as the Principal Investigator.[19][20]

-

Review and Correct: Before certifying, carefully review the effort distribution to ensure it accurately reflects the work performed during the reporting period. Any significant discrepancies should be corrected through a cost transfer. Variances of up to 5% are often considered allowable.[23]

Procurement

When purchasing goods or services with grant funds, specific procurement standards must be followed to ensure fair and open competition.[24]

Table 2: Federal Procurement Thresholds and Requirements

| Procurement Method | Threshold | Requirements |

| Micro-purchase | Under $10,000 | No competitive quotes required if the price is reasonable. Should be distributed equitably among qualified suppliers.[25] |

| Small purchase | $10,000 - $250,000 | Price or rate quotes must be obtained from an adequate number of qualified sources.[25] |

| Sealed Bid | Over $250,000 | Formal solicitation with public advertising. Awarded to the lowest responsive and responsible bidder.[25] |

| Competitive Proposal | Over $250,000 | Used when sealed bids are not appropriate. Awarded to the responsible firm whose proposal is most advantageous, with price and other factors considered.[25][26] |

| Sole Source | Any Amount | Requires justification that the item or service is only available from a single source.[24] |

Note: These thresholds are based on the Uniform Guidance and may be subject to change. Always consult the latest federal regulations and institutional policies.[27][28]

Subrecipient Monitoring

When a portion of the research is carried out by another organization (a subrecipient), the primary awardee (pass-through entity) is responsible for monitoring the subrecipient's compliance.[12][13][29]

Workflow for Subrecipient Monitoring:

Key Subrecipient Monitoring Activities:

-

Risk Assessment: Evaluate the subrecipient's financial stability and internal controls before issuing the subaward.[29][30]

-

Subaward Agreement: Execute a formal written agreement that clearly outlines the scope of work, budget, and applicable terms and conditions.[12][31]

-

Invoice Review: Scrutinize subrecipient invoices to ensure costs are allowable, allocable, and within the approved budget.[12]

-

Performance Monitoring: Maintain regular contact with the subrecipient to assess programmatic progress.[13]

-

Audit Verification: Confirm that the subrecipient has met any required audit obligations.[13]

Financial Reporting and Grant Closeout

Timely and accurate financial reporting is a mandatory component of grant compliance.[3][32]

Table 3: Common Financial Reporting Timelines

| Funding Agency | Report Name | Frequency | Due Date |

| NIH | Federal Financial Report (FFR) | Annually (for most grants) | 90 days after the end of the calendar quarter in which the budget period ends.[32] |

| Horizon Europe | Financial Statement | Per reporting period (typically 18 months) | Within 60 days after the end of the reporting period.[3][5] |

Upon completion of the project, a final set of reports is required for grant closeout. This typically includes a final financial report, a final invention statement, and a final performance report.[32] The closeout process must be completed within the timeframe specified by the funding agency, often 120 days after the project end date for NIH grants.[32]

Conclusion and Best Practices

Financial compliance for scientific grants is a multifaceted responsibility that requires diligence and a proactive approach. By understanding the regulatory landscape, implementing robust internal controls, and maintaining thorough documentation, researchers can ensure the responsible stewardship of research funds.

Key Best Practices for Financial Compliance:

-

Establish Clear Roles and Responsibilities: Define who is responsible for budget management, expenditure approval, and financial reporting.[33]

-

Maintain Accurate and Timely Records: Keep detailed documentation for all financial transactions.[34][35]

-

Regularly Reconcile Accounts: Periodically review grant expenditures against the approved budget and the general ledger.[7]

-

Communicate with Sponsored Programs Office: Your institution's sponsored programs office is a valuable resource for guidance on financial compliance matters.

-

Prepare for Audits: Maintain organized records in anticipation of potential audits from funding agencies or independent auditors.[34][36][37]

By adhering to these principles and methodologies, researchers can navigate the complexities of financial compliance with confidence, allowing them to focus on what they do best: advancing scientific knowledge and innovation.

References

- 1. Allowable vs. Unallowable Costs | Research Administration and Compliance [research.ncsu.edu]

- 2. Preparing the budget: allowable and unallowable costs | myResearchPath [myresearchpath.duke.edu]

- 3. Financial Reporting in Horizon Europe Projects [euro-funding.com]

- 4. How to complete your financial statement — HORIZON EUROPE and EURATOM - IT How To - Funding Tenders Opportunities [webgate.ec.europa.eu]

- 5. ufm.dk [ufm.dk]

- 6. Project Reporting|ERC [erc.europa.eu]

- 7. Best Practices for Grant Management | Office of Research [bu.edu]

- 8. kindsight.io [kindsight.io]

- 9. icahn.mssm.edu [icahn.mssm.edu]

- 10. Allowable and Non-Allowable Charges to Federal Grants | Cleveland State University [csuohio.edu]

- 11. 14.10 Allowable and Unallowable Costs [grants.nih.gov]

- 12. research.rice.edu [research.rice.edu]

- 13. compliance.gwu.edu [compliance.gwu.edu]

- 14. bosterbio.com [bosterbio.com]

- 15. How to plan and write a budget for research grant proposal? - PMC [pmc.ncbi.nlm.nih.gov]

- 16. brandonu.ca [brandonu.ca]

- 17. Budget Guidelines for Grant Proposals | Colgate University [colgate.edu]

- 18. 16.6 Allowable and Unallowable Costs [grants.nih.gov]

- 19. Effort Reporting | Office of the Vice Provost for Research [research.lehigh.edu]

- 20. Effort Reporting | University of North Texas [research.unt.edu]

- 21. research.arizona.edu [research.arizona.edu]

- 22. hamilton.edu [hamilton.edu]

- 23. Effort reporting guidelines + policy | Office of Research [research.ku.edu]

- 24. Procurement on Grants | Research | Illinois State [research.illinoisstate.edu]

- 25. nyu.edu [nyu.edu]

- 26. Procurement Guidelines for Purchases Made with Federal Funds - Colorado College [coloradocollege.edu]

- 27. 8.3.4 Procurement System Standards and Requirements [grants.nih.gov]

- 28. congress.gov [congress.gov]

- 29. myfedtrainer.com [myfedtrainer.com]

- 30. Subrecipient Monitoring Procedures | Grants and Contracts | Western Michigan University [wmich.edu]

- 31. Subrecipient Monitoring Policy - Sponsored Program Administration [research.wayne.edu]

- 32. grants.nih.gov [grants.nih.gov]

- 33. povertyactionlab.org [povertyactionlab.org]

- 34. 10 Grant Financial Management Best Practices for Success | Instrumentl [instrumentl.com]

- 35. Unify [withunify.org]

- 36. Regulations and Policies Related to the Financial Management of Research Grants - Optimizing the Nation's Investment in Academic Research - NCBI Bookshelf [ncbi.nlm.nih.gov]

- 37. Federal Research Grant Compliance Checklist | Moss Adams [mossadams.com]

Core Accounting Principles for Principal Investigators: A Technical Guide

For Researchers, Scientists, and Drug Development Professionals

This guide provides a comprehensive overview of the fundamental accounting principles essential for principal investigators (PIs) to effectively manage research funding. Adherence to these principles is crucial for ensuring compliance with funding agency regulations, maintaining the financial integrity of the research project, and securing future funding opportunities.

The Foundation: Key Accounting Concepts for Research

At its core, managing a research grant is analogous to managing a small business. The PI, as the head of this "business," is responsible for the scientific and financial success of the project. While the institution's sponsored programs office provides significant support, the ultimate responsibility for the fiscal health of the grant lies with the PI.[1] Understanding the following basic accounting tenets is therefore not just advantageous, but necessary.

A fundamental concept in grant accounting is the distinction between different types of funds and costs. Grants are a primary source of funding for many research endeavors, and they come with specific stipulations on how the money can be used.[2] Grant accounting involves the meticulous tracking of all financial activities related to a grant to ensure that funds are used in accordance with the grant agreement and any applicable regulations.[3]

The Principle of Allowability, Allocability, and Reasonableness

All costs charged to a sponsored project must meet three primary criteria:

-

Allowable: The cost is permitted by the terms of the grant, federal regulations (such as the Uniform Guidance 2 CFR 200), and the institution's policies.[4][5]

-

Allocable: The cost directly benefits the sponsored project. If a cost benefits multiple projects, it must be distributed among them in proportion to the benefit received by each.[4]

-

Reasonable: The cost is necessary for the performance of the project, and the amount is what a "prudent person" would pay in similar circumstances.[6][7]

Direct vs. Indirect Costs (Facilities & Administrative Costs)

A critical distinction in grant budgeting and management is between direct and indirect costs.

-

Direct Costs: These are expenses that can be specifically and easily identified with a particular research project.[8][9] Examples include the salaries of researchers working on the project, laboratory supplies, and project-specific travel.[10]

-

Indirect Costs (F&A or Overhead): These are costs incurred for common or joint objectives and cannot be easily attributed to a single project.[8][11] They represent the cost of using the institution's facilities and administrative support.[8] Examples include building maintenance, utilities, and the salaries of administrative staff.[10][11]

Indirect costs are typically calculated as a percentage of the direct costs and are a real and necessary component of conducting research.[8][10]

Budgeting for a Research Grant

A well-constructed budget is the financial roadmap for your research project. It should be a realistic and detailed estimation of all the costs required to achieve the project's objectives.

Typical Budget Categories and Allocations

The following table provides a sample breakdown of a research grant budget. The percentages are illustrative and will vary significantly based on the nature of the research.

| Budget Category | Sub-Category | Example Allocation (Lab-Based) | Example Allocation (Clinical Trial) |

| Personnel | PI Salary | 10% | 15% |

| Postdoctoral Researchers | 30% | 20% | |

| Graduate Students | 15% | 10% | |

| Technicians | 10% | 15% | |

| Subtotal | 65% | 60% | |

| Supplies | Laboratory Consumables | 15% | 5% |

| Patient Recruitment Materials | - | 10% | |

| Subtotal | 15% | 15% | |

| Equipment | Specialized Instruments | 5% | 2% |

| Travel | Conference Attendance | 3% | 3% |

| Site Visits | - | 5% | |

| Subtotal | 3% | 8% | |

| Other Direct Costs | Publication Fees | 2% | 2% |

| Patient Incentives | - | 5% | |

| Subtotal | 2% | 7% | |

| Total Direct Costs | 90% | 92% | |

| Indirect Costs (F&A) | 10% | 8% | |

| Total Project Cost | 100% | 100% |

Note: Indirect cost rates are negotiated by the institution and can vary. The national average for indirect cost rates at universities is around 53% of modified total direct costs.[12]

Managing Grant Funds: From Award to Closeout

Effective financial management is an ongoing process throughout the lifecycle of a grant.

The Grant Lifecycle: A Financial Perspective

The following diagram illustrates the key financial stages of a research grant from the perspective of a Principal Investigator.

"Experimental Protocol" for Allocating Expenses

Properly allocating expenses to a grant is a critical compliance activity. The following steps outline a systematic approach:

-

Verify Allowability: Before incurring any cost, confirm that it is an allowable expense according to the terms of the grant and institutional policy.

-

Determine Allocability: Ensure the expense directly benefits the project. For shared costs, develop a reasonable method for allocating the expense based on the proportional benefit to each project.

-

Ensure Reasonableness: The cost should be what a prudent person would pay. Obtain multiple quotes for significant purchases when required.

-

Document Thoroughly: Maintain detailed records of all expenditures, including invoices, receipts, and justifications for the expense.

-

Reconcile Regularly: Monthly, review the financial ledgers for your grant to ensure all charges are accurate and appropriate.[13]

Effort Reporting: A Critical Compliance Area

Effort reporting is the process of certifying that the salaries charged to a sponsored project are a reasonable reflection of the effort expended by the individuals working on that project.[14]

The Principles of Effort Reporting

-

Total Effort is 100%: An individual's total effort for their institution, for which they are compensated, must equal 100%, regardless of the number of hours worked.[15][16]

-

Certification is Required: PIs are typically required to certify their own effort and the effort of the staff working on their projects.[12][15]

-

After-the-Fact Certification: Effort is certified after the work has been performed.[12][15]

Sample Effort Reporting Scenarios

The following table illustrates common effort reporting scenarios and their correct handling.

| Scenario | Description | Correct Action |

| Committed Effort | A PI commits 25% of their effort to a grant in the proposal. | The PI must ensure that, on average, 25% of their work is dedicated to the project and that their salary is charged accordingly. |

| Reduced Effort | The PI needs to reduce their effort on the project to 15% due to other commitments. | The PI must obtain prior approval from the funding agency for a significant reduction in effort (typically 25% or more of the committed level).[13] |

| Cost Sharing | A faculty member contributes 10% of their effort to a project, but their salary is not charged to the grant. | This is considered "cost sharing" and must be tracked and reported as part of the effort certification. |

The diagram below illustrates the workflow for effort certification.

Financial Reporting and Compliance

PIs are responsible for providing periodic progress reports to the funding agency, which often have a financial component.[1] For federal grants, such as those from the National Institutes of Health (NIH), specific financial reporting forms are required.

Key Financial Reports

-

Research Performance Progress Report (RPPR): Submitted annually for NIH grants to report on scientific progress and use of funds.[8][10]

-

Federal Financial Report (FFR): Used to report the financial status of a grant. An annual FFR is required for most grants, with a final FFR due at the end of the project period.[8][9]

Allowable and Unallowable Costs

The following table provides examples of costs that are typically allowable and unallowable on federal grants, based on the Uniform Guidance.

| Allowable Costs | Unallowable Costs |

| Salaries and wages of personnel working on the project | Alcoholic beverages |

| Fringe benefits | Entertainment costs |

| Materials and supplies | Fines and penalties |

| Project-related travel | Lobbying costs |

| Equipment necessary for the research | Donations and contributions |

| Publication and dissemination costs | Memberships in social or community organizations |

| Subawards and consultant services |

This is not an exhaustive list. Always refer to the specific terms of your grant award and institutional policies.[16][17][18]

The relationship between direct, indirect, and unallowable costs is depicted in the diagram below.

Conclusion

While the administrative aspects of grant management can seem daunting, a solid understanding of these basic accounting principles will empower principal investigators to manage their research funds with confidence and integrity. Proactive financial management not only ensures compliance but also contributes to the overall success of the research project. Regular communication with your institution's sponsored programs office is key to navigating the complexities of grant administration.

References

- 1. financeandbusiness.ucdavis.edu [financeandbusiness.ucdavis.edu]

- 2. nwic.edu [nwic.edu]

- 3. fit.edu [fit.edu]

- 4. Refresher on Spending Sponsored Funds/ Allowable Expenses [ohio.edu]

- 5. Direct Costs | Office of Sponsored Programs [kent.edu]

- 6. northwestern.edu [northwestern.edu]

- 7. research.njit.edu [research.njit.edu]

- 8. Reporting Requirements | Grants & Funding [grants.nih.gov]

- 9. grants.nih.gov [grants.nih.gov]

- 10. Financial + Reporting Obligations of Grant Winners - Grant Engine [grantengine.com]

- 11. Federal Financial Reporting Guidelines - Financial Services [financialservices.wustl.edu]

- 12. mindingthecampus.org [mindingthecampus.org]

- 13. vetmed.tennessee.edu [vetmed.tennessee.edu]

- 14. uab.edu [uab.edu]

- 15. ospa.iastate.edu [ospa.iastate.edu]

- 16. Allowable vs. Unallowable Costs | Research Administration and Compliance [research.ncsu.edu]

- 17. morehouse.edu [morehouse.edu]

- 18. Sponsored Project Allowable and Unallowable Costs [blink.ucsd.edu]

The Impact of Financial Oversight on Research Outcomes: A Technical Guide for Researchers, Scientists, and Drug Development Professionals

An in-depth examination of the intricate relationship between financial oversight and the integrity, direction, and outcomes of scientific research, with a focus on the pharmaceutical and biomedical sectors.

This technical guide provides a comprehensive analysis of how various forms of financial oversight—ranging from funding sources and grant review processes to conflict-of-interest policies and regulatory requirements—collectively shape the landscape of scientific inquiry and the development of new therapies. For researchers, scientists, and drug development professionals, a nuanced understanding of these financial underpinnings is crucial for navigating the complexities of modern research with integrity and efficacy.

The Influence of Funding Sources on Research Outcomes

The source of funding is a primary determinant of the direction and, often, the outcome of research. The interests of the funding entity, whether a government agency, a philanthropic foundation, or a private corporation, can introduce both opportunities and biases into the research process.

Quantitative Analysis of Funding Source and Research Outcome

Multiple studies have quantitatively assessed the association between the source of funding, particularly from the pharmaceutical industry, and the reported outcomes of clinical trials. A consistent finding across this body of research is that industry-sponsored studies are more likely to report results favorable to the sponsor's product.

Table 1: Association Between Industry Sponsorship and Favorable Research Outcomes

| Study / Meta-Analysis | Comparison | Odds Ratio (OR) / Risk Ratio (RR) | 95% Confidence Interval (CI) | Key Finding |

| Keyhani et al. (2017)[1][2] | Principal investigators with financial ties vs. no ties | 3.57 (OR) | 1.7 to 7.7 | Financial ties of principal investigators are independently associated with positive clinical trial results.[2] |

| Lexchin et al. (2003)[3][4] | Industry-sponsored vs. non-industry sponsored studies | 4.05 (OR) | 2.98 to 5.51 | Studies sponsored by pharmaceutical companies were more likely to have outcomes favoring the sponsor.[3] |

| Bhandari et al. (2004)[5] | Industry-funded vs. non-industry funded trials | 1.8 (Adjusted OR) | 1.1 to 3.0 | Industry-funded trials are more likely to be associated with a statistically significant pro-industry result.[5] |

| Lundh et al. (2012)[6] | Industry-sponsored vs. non-industry sponsored studies | 1.24 (RR) for favorable efficacy results | 1.14 to 1.35 | Sponsorship of drug and device studies by the manufacturing company leads to more favorable efficacy results.[6] |

| Lundh et al. (2018)[7] | Industry-sponsored vs. non-industry sponsored studies | 1.27 (RR) for favorable efficacy results | 1.17 to 1.37 | Industry-sponsored studies more often had favorable efficacy results.[7] |

Methodological Considerations in Assessing Funding Bias

The methodologies employed in studies investigating funding bias are critical to the validity of their findings. These studies are often systematic reviews and meta-analyses of published clinical trials.

Experimental Protocol: Systematic Review of Industry Sponsorship and Research Outcomes

-

Objective: To investigate whether the funding of drug and device studies by the pharmaceutical or medical device industry is associated with research outcomes that are favorable to the funder.

-

Data Sources: Comprehensive searches of biomedical databases such as MEDLINE, Embase, and the Cochrane Methodology Register are conducted.[6] Reference lists of included articles and relevant systematic reviews are also manually searched.

-

Study Selection: Inclusion criteria typically focus on empirical studies (cross-sectional, cohort, or systematic reviews) that quantitatively compare primary research studies of drugs or medical devices sponsored by industry with studies having other sources of sponsorship.[6][8]

-

Quality Assessment: The methodological quality of the included studies is assessed using standardized tools to identify potential sources of bias.[7]

-

Statistical Analysis: Data from individual studies are pooled using meta-analytic techniques.[3] Odds ratios (ORs) or risk ratios (RRs) are calculated to estimate the association between industry sponsorship and favorable outcomes.[3][6] Statistical tests for heterogeneity are performed to assess the consistency of findings across studies.

Financial Conflicts of Interest in Research

Financial conflicts of interest (COIs) arise when a researcher's personal financial interests could potentially compromise, or appear to compromise, their professional judgment in the design, conduct, or reporting of research.[9] These conflicts can manifest in various forms, including stock ownership, consulting fees, and honoraria from companies whose products are being studied.[1]

Table 2: Prevalence and Types of Financial Ties Among Principal Investigators

| Study | Sample Size | PIs with Financial Ties | Common Types of Financial Ties |

| Keyhani et al. (2017)[1][2] | 195 randomized controlled trials, 397 principal investigators | 58% | Advisor/consultant payments, speakers' fees, unspecified financial ties, honorariums, employee relationships, travel fees, stock ownership, patents.[2] |

The Grant Review Process and Its Impact

The peer review of grant applications is a cornerstone of financial oversight in publicly funded research. However, this process is not without its own set of potential biases and inefficiencies that can affect which research gets funded and, consequently, the overall direction of a scientific field.

Studies have shown that the design of the review process itself can influence outcomes. Factors such as the composition of review panels, the use of specific rating scales, and the methods for ranking proposals can have substantial effects.[10] For instance, some ranking methods may favor more conventional and less risky projects, while others might provide greater opportunities for innovative and potentially transformative research.[10]

Regulatory Oversight and Administrative Burden

Financial oversight in research is also enacted through a complex framework of federal regulations and reporting requirements. While essential for ensuring accountability and the ethical conduct of research, these regulations can also impose a significant administrative burden on researchers.

A 2014 report from the National Science Board highlighted that a substantial portion of a researcher's time on federally funded projects is dedicated to administrative tasks rather than scientific work. This diversion of resources can slow the pace of discovery and innovation. Efforts are ongoing to streamline these processes and reduce unnecessary bureaucracy.

Visualizing the Impact of Financial Oversight

Diagrams can be powerful tools for illustrating the complex interplay of factors involved in financial oversight and their potential impact on research outcomes. The following diagrams, created using the DOT language, depict key workflows and signaling pathways.

Signaling Pathway of Financial Influence on Research

This diagram illustrates the potential pathways through which financial interests can influence the research process, from the initial design to the final publication of results.

Caption: Potential pathways of financial influence on research outcomes.

Experimental Workflow for Assessing Funding Bias

This diagram outlines the typical workflow for conducting a systematic review and meta-analysis to assess the impact of funding sources on research outcomes.

Caption: Workflow for a systematic review of funding bias.

Logical Relationship in Financial Oversight of Clinical Trials

This diagram illustrates the key components and their logical relationships in the financial oversight of a clinical trial, from initial budgeting to final reporting.

Caption: Financial oversight relationships in a clinical trial.

Conclusion and Best Practices

Financial oversight is an indispensable and multifaceted component of the research ecosystem. While it provides the necessary resources to fuel scientific advancement, it also introduces a complex web of potential influences that can impact the integrity and outcomes of research.

For researchers, scientists, and drug development professionals, navigating this landscape requires a commitment to transparency, rigorous methodology, and a critical awareness of potential biases. Key best practices include:

-

Full Disclosure: Transparently disclose all financial relationships and sources of funding in publications, presentations, and to research participants.

-

Methodological Rigor: Employ robust study designs, such as double-blinding and the use of appropriate comparators, to minimize potential bias.

-

Independent Oversight: Support and adhere to the policies of independent institutional review boards (IRBs) and conflict of interest committees.

-

Data Transparency: Promote the open sharing of research data and protocols to allow for independent verification of findings.

-

Education and Training: Continuously educate research teams on the ethical considerations and potential impacts of financial relationships in research.

By embracing these principles, the scientific community can work to mitigate the potential for undue financial influence and uphold the public's trust in the research enterprise.

References

- 1. pharmaceutical-journal.com [pharmaceutical-journal.com]

- 2. bmj.com [bmj.com]

- 3. Pharmaceutical industry sponsorship and research outcome and quality: systematic review - PMC [pmc.ncbi.nlm.nih.gov]

- 4. researchgate.net [researchgate.net]

- 5. Association between industry funding and statistically significant pro-industry findings in medical and surgical randomized trials - PMC [pmc.ncbi.nlm.nih.gov]

- 6. Industry sponsorship and research outcome - PubMed [pubmed.ncbi.nlm.nih.gov]

- 7. Industry sponsorship and research outcome: systematic review with meta-analysis - PubMed [pubmed.ncbi.nlm.nih.gov]

- 8. researchgate.net [researchgate.net]

- 9. dc.law.utah.edu [dc.law.utah.edu]

- 10. researchgate.net [researchgate.net]

Navigating the Financial Maze: A Technical Guide to Financial Planning for Long-Term Research Projects

For Researchers, Scientists, and Drug Development Professionals

Introduction

The journey from a groundbreaking scientific concept to a tangible therapeutic intervention is a long, arduous, and capital-intensive process. For researchers, scientists, and drug development professionals, navigating the complexities of long-term research projects requires not only scientific acumen but also a robust financial strategy. This in-depth technical guide provides a comprehensive framework for financial planning, budgeting, and resource allocation, tailored specifically to the unique challenges of multi-year research and development endeavors. A well-structured financial plan is not merely an administrative hurdle; it is a critical component of project feasibility, sustainability, and ultimate success. It provides a roadmap for resource management, facilitates informed decision-making, and instills confidence in stakeholders and funding bodies.

Core Principles of Financial Planning for Research Projects

Effective financial planning for long-term research is built upon a foundation of several key principles. These principles ensure that financial strategies are not only comprehensive but also adaptable to the inherently unpredictable nature of scientific discovery.

A sound financial plan begins with a clear and detailed articulation of the research project's objectives.[1] This involves breaking down the project into distinct phases and forecasting the expenses associated with each stage.[1] A thorough understanding of the core components of a research budget is the first step, which is broadly categorized into direct and indirect costs.[1] Direct costs are expenses that can be specifically attributed to the project, such as salaries, materials, and equipment.[1] Indirect costs, also known as overhead, encompass expenses that support the broader research environment, including utilities and administrative support.[1]

Regular monitoring of the budget is essential for the successful execution of the project.[1] This involves tracking actual expenditures against the projected costs to identify any potential overspending at an early stage, allowing for timely adjustments.[1] For long-term projects, it is advisable to schedule regular budget reviews, either on a monthly or quarterly basis.[1]

Quantitative Data Summary: The Financial Landscape of Drug Development

To effectively plan and budget for a long-term research project, it is crucial to have a clear understanding of the associated costs. The following tables provide a summary of quantitative data related to the costs of drug development, offering a baseline for financial forecasting.

Table 1: Estimated Costs of Drug Development Phases

| Phase | Average Cost (USD) | Cost Range (USD) |

| Preclinical | $15 - $100 Million | [2] |

| Phase I Clinical Trial | $25 Million | [2] |

| Phase II Clinical Trial | $60 Million | [2] |

| Phase III Clinical Trial | $350 Million | Up to $1 Billion[2] |

| FDA Review | $2 - $3 Million | [2] |

| Post-Marketing Surveillance | $20 - $300 Million | [2] |

Table 2: Breakdown of Preclinical Study Costs

| Cost Component | Percentage of Total Preclinical Budget | Average Cost (USD) |

| Chemistry, Manufacturing, and Controls (CMC) | 50% | $3.1 Million[3] |

| Toxicology | 25% | $1.5 Million[3] |

| Pharmacology | 10% | $600,000[3] |

| Other (e.g., ADME, Bioanalytical) | 15% | Varies |

Table 3: Average Clinical Trial Costs by Therapeutic Area (Across All Phases)

| Therapeutic Area | Average Combined Per-Study Cost (USD) |

| Pain and Anesthesia | $71.3 Million[4][5] |

| Ophthalmology | $49.8 Million[5] |

| Anti-infective | $41.2 Million[5] |

| Oncology | Varies Significantly |

| Dermatology | Lowest Overall Costs[4] |

| Endocrinology | Lowest Overall Costs[4] |

| Gastroenterology | Lowest Overall Costs[4] |

Table 4: Estimated Personnel Costs in a Research Budget

| Role | Factors to Consider in Budgeting |

| Principal Investigator (PI) | Percentage of effort dedicated to the project, salary, and fringe benefits.[6] |

| Postdoctoral Researchers | Salaries, fringe benefits, and potential for salary increases over the project's duration.[6] |

| Graduate Research Assistants | Stipends, tuition remission, and health insurance.[7] |

| Laboratory Technicians | Hourly wages or salaries, fringe benefits, and training costs.[6] |

| Administrative Staff | Salaries and fringe benefits, which must be well-justified as a direct cost.[7] |

Experimental Protocols: A Methodology for Financial Planning

This section outlines a detailed methodology for creating and managing a financial plan for a long-term research project. This protocol is designed to be a step-by-step guide for researchers and project managers.

Protocol 1: Financial Planning and Budget Development

1. Define Project Scope and Objectives:

- Clearly articulate the research goals, key milestones, and expected outcomes.

- Break down the project into distinct phases (e.g., discovery, preclinical, clinical Phase I, etc.).[1]

2. Identify and Categorize All Potential Costs:

- Direct Costs:

- Personnel: List all team members, their roles, percentage of effort, salaries, and fringe benefits.[6][8]

- Equipment: Identify all necessary equipment, including purchase price, maintenance contracts, and depreciation.

- Materials and Supplies: Estimate the cost of all consumables, reagents, and other laboratory supplies.

- Travel: Budget for conference attendance, collaborator meetings, and other project-related travel.[9]

- Contract Research Organizations (CROs) and Consultants: Obtain quotes for any outsourced services.

- Patient Recruitment and Care (for clinical trials): Include costs for advertising, screening, patient stipends, and clinical procedures.[10]

- Data Management and Analysis: Budget for statistical software, data storage, and bioinformatician support.

- Publication and Dissemination: Include fees for open-access publications and conference presentations.

- Indirect Costs (Overhead):

- Consult with your institution's sponsored programs office to determine the applicable indirect cost rate.[6][8] These costs typically cover facilities, administration, and other institutional support.[6][8]

3. Develop a Detailed Budget:

- Create a spreadsheet that itemizes all anticipated costs for each project phase.

- Include a budget justification that provides a rationale for each expense.[8]

- Factor in an inflation rate for multi-year projects.

4. Secure Funding:

- Identify potential funding sources, such as government grants, private foundations, and industry partnerships.

- Tailor grant proposals to the specific requirements of each funding agency.

5. Establish a System for Budget Monitoring and Reporting:

- Implement a system for tracking actual expenditures against the budget in real-time.[1]

- Generate regular financial reports for review by the project team and stakeholders.

- Establish a process for reviewing and approving any budget modifications.

Protocol 2: Financial Risk Management

1. Identify Potential Financial Risks:

- Cost Overruns: Unforeseen increases in the cost of supplies, equipment, or services.

- Project Delays: Setbacks in the research timeline that can lead to increased personnel costs and other expenses.

- Funding Shortfalls: Reductions in or loss of funding from a primary source.

- Changes in Project Scope: Modifications to the research plan that require additional resources.

2. Assess and Prioritize Risks:

- Evaluate the likelihood and potential impact of each identified risk.

- Prioritize risks based on their potential to disrupt the project's financial stability.

3. Develop Risk Mitigation Strategies:

- Contingency Fund: Allocate a percentage of the total budget (typically 10-20%) to a contingency fund to cover unexpected costs.[11]

- Regular Budget Reviews: Conduct frequent reviews of the budget to identify and address potential issues early.[1]

- Diversify Funding Sources: Seek funding from multiple sources to reduce reliance on a single grant or contract.

- Fixed-Price Contracts: When outsourcing, negotiate fixed-price contracts to control costs.

4. Monitor and Review Risks:

- Continuously monitor the identified risks throughout the project lifecycle.

- Regularly review and update the risk management plan as needed.

Mandatory Visualizations

The following diagrams illustrate key conceptual frameworks relevant to financial planning in long-term research projects.

Caption: A high-level overview of the drug discovery and development workflow.

Caption: The PI3K/AKT/mTOR signaling pathway, a common target in drug development.

References

- 1. clinicaltrialrisk.org [clinicaltrialrisk.org]

- 2. greenfieldchemical.com [greenfieldchemical.com]

- 3. contractpharma.com [contractpharma.com]

- 4. Examination of Clinical Trial Costs and Barriers for Drug Development | ASPE [aspe.hhs.gov]

- 5. researchgate.net [researchgate.net]

- 6. dcu.ie [dcu.ie]

- 7. Budget Basics & Cost Categories | University of North Texas [research.unt.edu]

- 8. westernsydney.edu.au [westernsydney.edu.au]

- 9. Compile a research budget [info.lse.ac.uk]

- 10. ccrps.org [ccrps.org]

- 11. abacum.ai [abacum.ai]

ACCA for Scientists: A Technical Guide to Mastering Laboratory Budget Management

For Researchers, Scientists, and Drug Development Professionals

Introduction

In the competitive landscape of scientific research and drug development, financial acumen is as crucial as scientific expertise. The effective management of a laboratory's budget can be the determining factor in the success and sustainability of research projects. For scientists and researchers stepping into leadership roles, a robust understanding of financial principles is no longer a peripheral skill but a core competency. This guide provides an in-depth technical overview of how the principles of the Association of Chartered Certified Accountants (ACCA) qualification can be applied to the unique financial challenges of managing a laboratory budget.

The ACCA qualification is a globally recognized standard for excellence in accounting and finance, covering a comprehensive curriculum that includes financial and management accounting, performance management, and financial control.[1] While traditionally associated with corporate finance, the principles underpinning the ACCA syllabus are highly transferable and offer a structured framework for scientists to navigate the complexities of lab budgeting, resource allocation, and financial reporting. This whitepaper will bridge the gap between complex financial theory and the day-to-day realities of the laboratory, empowering researchers to make sound financial decisions that drive scientific innovation.

Core ACCA Principles for Laboratory Financial Management

The ACCA qualification equips professionals with a versatile skill set in financial management. For laboratory managers, three core areas of the ACCA syllabus are particularly pertinent:

-

Financial Planning and Control: This involves the setting of financial objectives and the subsequent monitoring of performance against these targets. For a lab, this translates to creating detailed project budgets, forecasting expenditures, and implementing controls to prevent overspending.

-

Performance Management: This area of the ACCA syllabus focuses on the application of management accounting techniques to monitor and improve the performance of an organization. In a research context, this involves using key performance indicators (KPIs) to track research productivity, cost-effectiveness of experiments, and the overall return on research investment.

-

Financial Management: This encompasses the strategic aspects of finance, such as investment appraisal and risk management. For a lab manager, this could involve making decisions on expensive equipment purchases, managing grant funding, and assessing the financial risks associated with new research projects.

By applying these core principles, scientists can move beyond simple budget tracking to a more strategic approach to financial management, ensuring the long-term viability and success of their research endeavors.

Data-Driven Budgeting for Research and Development

A cornerstone of the ACCA approach to financial management is the use of data to inform budgeting and decision-making. In a laboratory setting, particularly in drug development, understanding the cost structure of research is paramount.

Table 1: Estimated Cost Breakdown of Drug Development

The journey of a new drug from the laboratory to the market is a long and expensive process. The table below summarizes the estimated out-of-pocket costs at each major phase of development. These figures highlight the necessity for meticulous long-term financial planning.

| Development Phase | Estimated Out-of-Pocket Cost (USD) | Key Activities |

| Preclinical | $15 million - $100 million | Laboratory studies, animal testing, compound identification.[2] |

| Clinical Trials - Phase I | Approximately $25 million | Initial safety testing in a small group of healthy volunteers.[2] |

| Clinical Trials - Phase II | Approximately $60 million | Efficacy and further safety testing in a larger group of patients.[2] |

| Clinical Trials - Phase III | $200 million - $500 million+ | Large-scale efficacy and safety testing in diverse patient populations.[3] |

| FDA Review & Post-Marketing | $20 million - $300 million+ | Regulatory submission and ongoing safety monitoring after approval.[2] |

Note: These figures are estimates and can vary significantly based on the therapeutic area and complexity of the drug.

Table 2: Typical Budget Allocation in an Academic Research Lab

While drug development represents a high-cost scenario, academic research labs also require careful budget allocation. The following table provides a general breakdown of common expenditures.

| Budget Category | Typical Allocation | Key Considerations |

| Personnel | 50% - 70% | Salaries, benefits, and training for researchers, technicians, and students.[4] |

| Consumables & Supplies | 15% - 25% | Reagents, chemicals, labware, and other disposable items.[4] |

| Equipment & Maintenance | 10% - 20% | Purchase of new equipment, service contracts, and repairs.[4] |

| Travel & Publications | 3% - 5% | Conference attendance, publication fees, and data sharing costs. |

| Overhead/Indirect Costs | 20% - 60% of direct costs | Institutional support costs such as utilities, administration, and facility maintenance.[5] |

Note: Overhead rates are typically negotiated with the funding institution and can vary widely.

Applying ACCA Techniques in the Laboratory

Activity-Based Costing (ABC) in Research

Traditional costing methods often allocate overheads based on broad measures like labor hours, which can be inaccurate in a research environment where different projects consume resources at vastly different rates. Activity-Based Costing (ABC), a technique covered in the ACCA syllabus, offers a more precise method by assigning costs to specific activities.[5][6][7]

In a lab, activities could include:

-

Running a specific assay

-

Maintaining a cell culture line

-

Operating a high-performance computing cluster

-

Preparing samples for sequencing

By identifying the "cost drivers" for each activity (e.g., number of plates for an assay, hours of use for a microscope), a lab manager can gain a much clearer understanding of the true cost of each research project. This granular data is invaluable for making informed decisions about resource allocation and for justifying budget requests.

Key Performance Indicators (KPIs) for Lab Management

Performance management is a critical component of the ACCA qualification, and the use of KPIs is central to this discipline.[8][9] For a laboratory, KPIs can provide a clear and concise way to track progress towards scientific and financial goals.

Table 3: Key Performance Indicators for Laboratory Budget Management

| KPI Category | Example KPI | Description |

| Financial | Budget Variance | The difference between the budgeted and actual expenditure for a project or the entire lab. |

| Cost per Publication/Patent | A measure of the financial investment required to produce a key research output. | |

| Grant Funding Success Rate | The percentage of grant applications that are successfully funded. | |

| Operational | Equipment Utilization Rate | The percentage of time a piece of equipment is in active use, helping to identify underutilized assets.[10] |

| Inventory Turnover | The rate at which laboratory supplies are used and replenished, highlighting potential inefficiencies in stock management.[10] | |

| Scientific | Number of Experiments per Month | A measure of the lab's research activity and productivity. |

| Data Turnaround Time | The time taken from sample receipt to the delivery of results, indicating operational efficiency.[10] |

Regularly monitoring these KPIs can help lab managers identify areas for improvement, optimize resource allocation, and demonstrate the value of their research to funding bodies.

Strategic Financial Decisions in the Lab

Investment Appraisal: The "Buy vs. Lease" Decision

A common and significant financial decision for any lab manager is the acquisition of new equipment. The ACCA syllabus provides a robust framework for investment appraisal, which can be directly applied to the "buy vs. lease" dilemma.

A cost-benefit analysis should be conducted, considering both the quantitative and qualitative factors.[11][12]

Table 4: Cost-Benefit Analysis Framework for Equipment Acquisition

| Factor | Purchase | Lease |

| Upfront Cost | High initial capital outlay. | Lower initial payment or no down payment.[13] |

| Total Cost of Ownership | Includes purchase price, maintenance, and repairs. Potential for lower long-term cost if the equipment has a long lifespan.[14] | Fixed monthly payments, often including maintenance. Can be more expensive over the long term.[14] |

| Depreciation & Tax | The equipment is a depreciating asset, which can offer tax benefits.[15] | Lease payments are typically treated as tax-deductible operating expenses.[15] |

| Technology Obsolescence | Risk of being locked into outdated technology. | Easier to upgrade to newer models at the end of the lease term.[13] |

| Flexibility | Full ownership and control over the equipment. | Less flexibility in terms of customization and usage.[14] |

A decision tree can be a useful tool for visualizing the potential outcomes and associated costs of each option.

References

- 1. Intellectual Property Valuation in Biotechnology and Pharmaceuticals [wipo.int]

- 2. wipo.int [wipo.int]

- 3. grants.gatech.edu [grants.gatech.edu]

- 4. accaglobal.com [accaglobal.com]

- 5. Activity-based Costing (ABC) | Research Starters | EBSCO Research [ebsco.com]

- 6. corporatefinanceinstitute.com [corporatefinanceinstitute.com]

- 7. Activity-Based Costing Explained: Method, Benefits, and Real-Life Example [investopedia.com]

- 8. researchgate.net [researchgate.net]

- 9. Acca Performance Management Study Guide | ACCA PM Exam [xylemlearning.com]

- 10. ifm.flagshipinc.com [ifm.flagshipinc.com]

- 11. What is the cost-benefit analysis of purchasing vs. leasing lab equipment? [needle.tube]

- 12. Cost Benefit Analysis for Equipment Investments: Making Informed Decisions [needle.tube]

- 13. Hidden Costs of Buying Lab Equipment & How to Avoid Them [excedr.com]

- 14. dergipark.org.tr [dergipark.org.tr]

- 15. drugpatentwatch.com [drugpatentwatch.com]

A Researcher's In-depth Guide to Key Financial Terminology in Grant Applications

For researchers, scientists, and drug development professionals, securing funding is the lifeblood of innovation. A meticulously crafted research proposal can be quickly undermined by a poorly constructed budget or a misunderstanding of key financial terminology. This technical guide provides a comprehensive overview of the essential financial terms and concepts necessary to navigate the complexities of research grant applications, ensuring your groundbreaking work is built on a solid financial foundation.

Core Financial Concepts in Grant Proposals

A successful grant proposal demonstrates not only scientific merit but also fiscal responsibility. Understanding the language of grant funding agencies is paramount. The following terms represent the foundational vocabulary for any researcher preparing a grant budget.

Budget and Budget Justification: The budget is the detailed financial plan of the research project, outlining all anticipated costs.[1][2][3] The budget justification is a narrative explanation of each line item in the budget, clarifying why each cost is necessary and how the amount was calculated.[2][4]

Direct Costs: These are expenses that can be directly attributed to a specific research project.[1][5] Common direct costs include:

-

Personnel Costs: Salaries and wages for the principal investigator, co-investigators, postdoctoral researchers, graduate students, and technicians.[5][6][7]

-

Fringe Benefits: Employer contributions for benefits such as health insurance, retirement plans, and social security.[8][9][10][11] These are typically calculated as a percentage of salaries and wages.

-

Equipment: The cost of purchasing durable equipment necessary for the research.[6][7]

-

Travel: Expenses for attending conferences, conducting fieldwork, or collaborating with other researchers.[6][7]

-

Materials and Supplies: Consumable items required for the research, such as chemicals, glassware, and software.[5][7]

-

Publication Costs: Fees associated with publishing research findings in scientific journals.[7]

-

Consultant Services: Fees for specialized services from individuals who are not employees of the grantee institution.[6][7]

-

Subawards/Subcontracts: Funds allocated to a collaborating institution to perform a portion of the research.[5]

Indirect Costs (Facilities & Administrative Costs or F&A): These are costs incurred by the institution that are not directly tied to a specific research project but are necessary for the general operation of the organization, such as utilities, building maintenance, and administrative support.[5][6][12] Indirect costs are typically calculated as a percentage of a portion of the direct costs, known as the Modified Total Direct Cost (MTDC) base.[2][7]

Cost Sharing (Matching Funds): This refers to the portion of project costs not borne by the funding agency. It can be a mandatory requirement of the grant or a voluntary contribution by the institution to demonstrate its commitment to the project.[13][14][15]

Quantitative Data for Budget Preparation

To aid in the preparation of a realistic and well-supported budget, the following tables summarize typical quantitative data for key financial components of a research grant application.

Table 1: Indirect Cost (F&A) Rates

| Funding Agency/Source | Typical Indirect Cost Rate | Notes |

| National Institutes of Health (NIH) | Capped at 15% (as of Feb 2025) | This is a significant recent change from previously negotiated rates which could be much higher.[1][2][3][16] |

| Other Federal Agencies | Varies, often between 25% and 70% | Rates are typically negotiated between the university and the federal government.[3][5] |

| Private Foundations | Often lower, ranging from 0% to 20% | Many foundations have a policy of not covering indirect costs or capping them at a low percentage.[12] |

Table 2: Fringe Benefit Rates (Illustrative Examples)

| Institution Type/Employee Category | Typical Fringe Benefit Rate | Components Included |

| Full-Time Faculty & Staff | 28% - 37% | Health insurance, retirement, Social Security, Medicare, life insurance, disability insurance.[8][10][11] |