CDFI

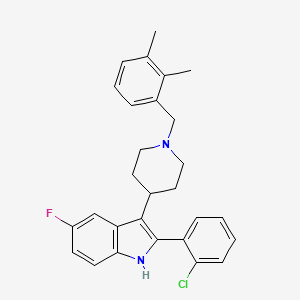

Description

BenchChem offers high-quality this compound suitable for many research applications. Different packaging options are available to accommodate customers' requirements. Please inquire for more information about this compound including the price, delivery time, and more detailed information at info@benchchem.com.

Propriétés

Formule moléculaire |

C28H28ClFN2 |

|---|---|

Poids moléculaire |

447.0 g/mol |

Nom IUPAC |

2-(2-chlorophenyl)-3-[1-[(2,3-dimethylphenyl)methyl]piperidin-4-yl]-5-fluoro-1H-indole |

InChI |

InChI=1S/C28H28ClFN2/c1-18-6-5-7-21(19(18)2)17-32-14-12-20(13-15-32)27-24-16-22(30)10-11-26(24)31-28(27)23-8-3-4-9-25(23)29/h3-11,16,20,31H,12-15,17H2,1-2H3 |

Clé InChI |

KRLGPLURVLJNOH-UHFFFAOYSA-N |

SMILES canonique |

CC1=C(C(=CC=C1)CN2CCC(CC2)C3=C(NC4=C3C=C(C=C4)F)C5=CC=CC=C5Cl)C |

Origine du produit |

United States |

Foundational & Exploratory

The Genesis and Evolution of Community Development Financial Institutions: A Technical Guide

An in-depth analysis of the origins, history, and impact of a specialized sector dedicated to empowering underserved communities.

Community Development Financial Institutions (CDFIs) represent a unique and vital component of the United States financial landscape. Operating at the intersection of social mission and market-based strategies, these institutions have a rich history rooted in the fight for economic equity and have evolved into a powerful force for community revitalization. This technical guide explores the origins, historical development, and operational frameworks of CDFIs, providing researchers, scientists, and drug development professionals with a comprehensive understanding of their role and impact.

I. Precursors and Early Origins: A Legacy of Financial Inclusion

The concept of community-oriented finance predates the formal establishment of CDFIs. The historical antecedents of these institutions can be traced back to various efforts to provide financial services to marginalized communities who were systematically excluded from the mainstream banking sector.

Early Seeds of Community Finance (1880s-1960s):

-

Minority-Owned Banks: Beginning in the 1880s, the establishment of the first minority-owned banks marked a significant step towards financial self-determination for communities facing discrimination.[1]

-

Credit Unions: The creation of credit unions in the 1930s and 1940s introduced a cooperative model of finance, allowing members to pool their resources and provide affordable credit to one another.[1][2]

-

Mutual Aid Societies: With even deeper roots, mutual aid organizations, particularly within Black communities, have a long history of providing financial support and welfare services, demonstrating a tradition of collective economic support.[2]

The Civil Rights Era and the Rise of Community Development (1960s-1970s):

The Civil Rights Movement and President Lyndon B. Johnson's "War on Poverty" in the 1960s created a fertile ground for the emergence of more formalized community development efforts.[3] This era saw the birth of Community Development Corporations (CDCs) , which were established to address the economic needs of urban and rural low-income communities.[3] The 1970s witnessed the establishment of the first community development banks, such as South Shore Bank in Chicago (1973), and community development credit unions, like the Santa Cruz Community Credit Union (1977).[3]

II. The Birth of the CDFI Movement and the Role of Federal Legislation

While the grassroots efforts of the preceding decades laid the groundwork, the 1990s marked a pivotal moment in the formalization and expansion of the community development finance sector.

The Riegle Community Development and Regulatory Improvement Act of 1994:

This bipartisan legislation stands as the cornerstone of the modern this compound movement.[4][5][6] It officially defined and recognized Community Development Financial Institutions and, most importantly, established the Community Development Financial Institutions Fund (this compound Fund) within the U.S. Department of the Treasury.[1][4][5][6] The primary purpose of the this compound Fund is to promote economic revitalization and community development by providing financial and technical assistance to certified CDFIs.[4][5]

The creation of the this compound Fund was the culmination of dedicated advocacy by organizations like the National Federation of Community Development Credit Unions and the National Association of Community Development Loan Funds (now the Opportunity Finance Network), who formed the this compound Coalition to champion the cause.[4]

III. The Structure and Function of the this compound Ecosystem

CDFIs are diverse in their legal structure and the specific needs they address, but they all share a common mission of serving low-income and underserved communities.

Types of CDFIs:

CDFIs can be categorized into several main types:

-

Community Development Banks: Depository institutions that provide a range of banking services with a focus on community development.

-

Community Development Credit Unions: Member-owned depository institutions that serve low- and moderate-income communities.

-

Community Development Loan Funds: Non-depository institutions that provide financing for businesses, housing, and community facilities.

-

Community Development Venture Capital Funds: Provide equity and management expertise to small, often minority-owned businesses.

-

Microenterprise Development Loan Funds: Focus on providing small loans and technical assistance to entrepreneurs who cannot access traditional financing.

Diagram: The this compound Ecosystem

Caption: This diagram illustrates the flow of capital from various funding sources through different types of CDFIs to generate positive impacts in underserved communities.

IV. Quantitative Growth and Impact of the this compound Industry

Since the establishment of the this compound Fund, the this compound industry has experienced significant growth in both the number of institutions and the volume of their activities. This growth has translated into substantial positive impacts in the communities they serve.

Table 1: Growth of Certified Community Development Financial Institutions

| Year | Number of Certified CDFIs |

| 1997 | 196 |

| 2013 | 809 |

| 2020 | 1,146 |

| 2024 | 1,426 |

Sources: this compound Fund, CUCollaborate[2][7]

Table 2: Growth in Total Assets of this compound Banks and Credit Unions

| Year | Total Assets |

| 2018 | ~$150 Billion |

| 2023 | $452 Billion |

Source: Federal Reserve Bank of New York[1]

Table 3: this compound Fund Award and Allocation History (Cumulative)

| Program | Amount |

| This compound Program & NACA Program Awards | > $7.4 Billion (as of FY 2023) |

| New Markets Tax Credit (NMTC) Program | $76.0 Billion (as of FY 2023) |

| This compound Bond Guarantee Program | ~$2.5 Billion (as of FY 2023) |

Source: this compound Fund Annual Report FY 2023[5]

The impact of this financial activity is significant. For example, through fiscal year 2018, members of the Opportunity Finance Network, a leading network of CDFIs, had provided over $75 billion in lending, which led to the creation or maintenance of 1.56 million jobs, the start or expansion of over 419,000 businesses and microenterprises, and the development or rehabilitation of more than 2.1 million housing units.[8]

V. Methodologies: Certification and Impact Evaluation

The effectiveness of the this compound model relies on a rigorous certification process and a commitment to measuring impact.

This compound Certification Process:

To become a certified this compound, an organization must meet specific requirements set by the this compound Fund. The process ensures that the institution has a primary mission of community development, serves an eligible target market, provides development services in addition to financing, and maintains accountability to its target market.

Diagram: this compound Certification Workflow

References

- 1. These Maps Show the Growth of CDFIs | CapNexus by Partners for the Common Good [capnexus.org]

- 2. cdfifund.gov [cdfifund.gov]

- 3. Publications | Community Development Financial Institutions Fund [cdfifund.gov]

- 4. Appropriations History – this compound Coalition [this compound.org]

- 5. cdfifund.gov [cdfifund.gov]

- 6. newyorkfed.org [newyorkfed.org]

- 7. A History of this compound Certifications and this compound Awards [cucollaborate.com]

- 8. forbes.com [forbes.com]

A Technical Guide to the Core Mission and Purpose of Community Development Financial Institutions (CDFIs)

Audience: Researchers, Scientists, and Drug Development Professionals

Abstract: Community Development Financial Institutions (CDFIs) are specialized financial entities with a primary mission of promoting community development in economically distressed urban, rural, and Native communities.[1][2][3] Unlike traditional financial institutions that prioritize profit maximization, CDFIs focus on a "double bottom line," measuring success through both financial returns and positive community impact.[2] This guide provides a technical overview of the fundamental purpose, operational framework, and impact pathways of CDFIs, presented in a format amenable to a research and development audience.

Primary Mission: Catalyzing Economic Opportunity in Underserved Markets

The central tenet of a CDFI is to provide fair and responsible financing to communities and individuals that mainstream finance does not traditionally reach.[1] Their mission is purposefully directed toward improving the social and economic conditions of underserved people and residents of economically distressed communities.[4][5] This is achieved by filling critical capital gaps and counteracting the effects of historical practices like redlining.[6]

The core activities stemming from this mission include:

-

Providing Financial Products and Services: CDFIs offer a range of financial products, including loans for affordable housing, small businesses, and community facilities like health centers and schools.[6][7][8] They are often able to offer more flexible underwriting standards than traditional banks.[7][9]

-

Delivering Development Services: Beyond financing, CDFIs provide crucial technical assistance and training to their clients.[2][6] This can include financial literacy education, business coaching, and counseling to help individuals and businesses build financial capability.[1][9][10]

-

Fostering Community Revitalization: By injecting capital and support into disinvested areas, CDFIs aim to create jobs, build wealth, and support the development of essential community assets.[6][7]

Quantitative Overview of the this compound Sector

The this compound industry has grown into a significant component of the financial landscape, channeling capital into communities that need it most. The following table summarizes key quantitative data about the sector.

| Metric | Value | Source Description |

| Number of Certified CDFIs | Over 1,400 | There are more than 1,400 certified CDFIs operating nationwide in the United States.[1][7] |

| Total Assets Managed | Over $222 billion | The this compound industry collectively manages more than $222 billion in assets.[1] |

| Client Demographics | ||

| - Low-Income Clients | 85% | A vast majority of this compound clients are from low-income backgrounds.[1] |

| - Clients of Color | 66% | Two-thirds of individuals and businesses served by CDFIs are people of color.[1] |

| - Women Clients | 48% | Nearly half of all this compound clients are women.[1] |

| - Rural Clients | 26% | Over a quarter of this compound services are directed towards rural communities.[1] |

| Leverage Ratio | 8x | For every dollar invested in a this compound, they are able to leverage it eight times to invest in communities.[1] |

| Net Charge-Off Rate | 0.58% | CDFIs maintain a very low net charge-off rate, indicating strong lending practices.[1] |

The this compound Capital Flow and Impact Pathway

The following diagram illustrates the logical flow of capital through a this compound to generate community impact. It demonstrates how CDFIs attract capital from various sources and deploy it alongside development services to achieve their mission.

References

- 1. ofn.org [ofn.org]

- 2. This compound.org [this compound.org]

- 3. Community development financial institution - Wikipedia [en.wikipedia.org]

- 4. This compound Certification Updates: Primary Mission [cucollaborate.com]

- 5. cdfifund.gov [cdfifund.gov]

- 6. An Overview of Community Development Financial Institutions [consumercomplianceoutlook.org]

- 7. jpmorgan.com [jpmorgan.com]

- 8. faithinvest.org [faithinvest.org]

- 9. How Do CDFIs Work? | Forward Community Investments [forwardci.org]

- 10. letspresta.com [letspresta.com]

What are the different types of Community Development Financial Institutions?

Community Development Financial Institutions (CDFIs) are specialized financial entities dedicated to delivering responsible and affordable lending to foster economic opportunity in low-income and underserved communities. Certified by the U.S. Department of the Treasury's CDFI Fund, these institutions play a critical role in empowering individuals and communities that lack access to mainstream financial services. This technical guide provides an in-depth overview of the primary types of CDFIs, their operational frameworks, and their impact on community development.

Core Types of Community Development Financial Institutions

The this compound ecosystem is comprised of several distinct institutional types, each with a unique approach to serving its target market. The primary categories include Community Development Banks, Community Development Credit Unions, Community Development Loan Funds, and Community Development Venture Capital Funds.

Community Development Banks (CD Banks)

Community Development Banks are for-profit, federally regulated and insured depository institutions with a primary mission of promoting community development.[1][2][3] They distinguish themselves from traditional banks by their targeted focus on providing financial products and services to low- and moderate-income (LMI) individuals and communities.[4] A significant portion of CD Banks also hold the designation of Minority Depository Institutions (MDIs), specifically serving minority communities.[4]

Key Operational Characteristics:

-

Regulation: Subject to the same safety and soundness regulations as traditional banks, they are overseen by federal agencies such as the Office of the Comptroller of the Currency (OCC), the Federal Deposit Insurance Corporation (FDIC), and the Federal Reserve.

-

Products and Services: Offer a range of services including mortgage financing for first-time homebuyers, commercial real estate loans, small business loans, and consumer banking services.[2][3]

-

Accountability: Maintain accountability to their target communities, often through community representation on their boards of directors.

Community Development Credit Unions (CD CUs)

Community Development Credit Unions are non-profit, member-owned financial cooperatives.[2][5] Their fundamental purpose is to promote savings, provide affordable credit, and offer retail financial services to their members, who are typically from LMI communities.[2][5]

Key Operational Characteristics:

-

Ownership and Governance: As cooperatives, they are owned and governed by their members.

-

Regulation: Regulated by the National Credit Union Administration (NCUA), which also insures member deposits.[2]

-

Products and Services: Provide essential financial products such as savings and checking accounts, personal loans, and mortgage loans, often with more flexible underwriting standards than traditional institutions.[2] They also frequently offer financial literacy training and counseling.[6]

Community Development Loan Funds (CD LFs)

Community Development Loan Funds are typically non-profit organizations that provide financing and technical assistance to a diverse range of borrowers.[2][5][7] These borrowers often include small businesses, non-profit organizations, affordable housing developers, and community facilities.[2][5]

Key Operational Characteristics:

-

Flexibility: As non-regulated lenders, CD LFs can offer more flexible loan terms and accept unconventional collateral.[7][8]

-

Specialization: Many CD LFs specialize in a particular area of lending, such as microenterprise, small business, housing, or community service organizations.[2] For instance, microenterprise funds focus on providing small amounts of capital to entrepreneurs.[8]

-

Development Services: A core component of their model is providing development services, such as business planning and financial management assistance, in conjunction with their lending activities.[9]

Community Development Venture Capital Funds (CD VCs)

Community Development Venture Capital Funds can be either for-profit or non-profit entities that provide equity and debt with equity features to small and medium-sized businesses in economically distressed communities.[2][8] Their primary objective is to generate jobs and foster wealth creation within these communities.[2]

Key Operational Characteristics:

-

Investment Focus: Target businesses with the potential for high growth and significant community impact.

-

Financing Instruments: Utilize equity investments and other risk capital instruments that are often unavailable from traditional lenders.

-

Active Partnership: Typically take an active role in their portfolio companies, providing strategic guidance and mentorship.

Comparative Analysis of this compound Types

The following table summarizes the key characteristics of the different types of Community Development Financial Institutions for easy comparison.

| Feature | Community Development Banks (CD Banks) | Community Development Credit Unions (CD CUs) | Community Development Loan Funds (CD LFs) | Community Development Venture Capital Funds (CD VCs) |

| Primary Mission | Promote community development through targeted lending and investment in underserved communities.[1][4] | Promote asset ownership and savings, and provide affordable credit and financial services to members.[2][5] | Provide financing and development services to small businesses, nonprofits, and housing projects.[2][5][7] | Create jobs and economic opportunities by investing in businesses in distressed communities.[2] |

| Legal Structure | For-profit corporation.[3] | Non-profit financial cooperative.[2] | Typically non-profit.[1] | For-profit or non-profit.[2] |

| Regulation | Federally regulated and insured (FDIC, Federal Reserve, OCC).[3] | Regulated and insured by the National Credit Union Administration (NCUA).[2] | Generally not federally regulated as depository institutions. | Varies based on structure. |

| Typical Borrowers | Individuals, small businesses, non-profit organizations, and housing developers in LMI communities.[2][3] | Members from low- and moderate-income communities.[2] | Small businesses, non-profits, social service facilities, and housing projects.[2] | Small and medium-sized businesses with high growth potential.[2] |

| Primary Products | Mortgage financing, home improvement loans, business loans, consumer banking services.[2][3] | Deposit accounts, savings accounts, personal loans, mortgage loans.[2] | Flexible loans for small businesses, housing development, and community facilities.[7][10] | Equity investments, debt with equity features.[11] |

| Capital Sources | Customer deposits, private and public investments.[3][8] | Member deposits (shares).[8] | Grants, loans from banks and foundations, government funding.[12] | Investments from individuals, foundations, and other institutions. |

Logical Relationships and Workflows

The following diagrams illustrate the fundamental relationships and operational flows within the this compound ecosystem.

Caption: Funding flows from public and private sources to different this compound types, which in turn provide capital and services to their target communities.

Caption: The sequential process for a financial institution to become a certified this compound, meeting all eligibility requirements.

References

- 1. Community Development Financial Institution (this compound) and Community Development (CD) Bank Resource Directory | OCC [occ.gov]

- 2. What Are the Different Types of Community Development Financial Institutions (CDFIs)? - Partner Community Capital [partnercap.org]

- 3. ecebizopssupports.phmc.org [ecebizopssupports.phmc.org]

- 4. fdic.gov [fdic.gov]

- 5. jpmorgan.com [jpmorgan.com]

- 6. Credit Union this compound Certification | CUCollaborate [cucollaborate.com]

- 7. Facility Refinancing Guide to Community Development Financial Institutions | Local Initiatives Support Corporation [lisc.org]

- 8. About CDFIs – this compound Coalition [this compound.org]

- 9. fundingo.com [fundingo.com]

- 10. capshift.com [capshift.com]

- 11. cdfifund.gov [cdfifund.gov]

- 12. ofn.org [ofn.org]

A Technical Guide to CDFI Certification and Regulation in the United States

For Researchers, Scientists, and Drug Development Professionals

This guide provides a comprehensive overview of the certification and regulatory framework for Community Development Financial Institutions (CDFIs) in the United States. The processes and standards detailed below are primarily governed by the U.S. Department of the Treasury's Community Development Financial Institutions Fund (CDFI Fund).

Core Principles of this compound Certification

To become a certified this compound, an organization must demonstrate to the this compound Fund that it meets seven key criteria.[1][2] This certification provides access to a network of mission-driven institutions and makes the organization eligible for various funding and technical assistance programs offered by the this compound Fund.[2][3]

A foundational requirement for certification is that the institution has a primary mission of promoting community development.[1][2] Furthermore, at least 60% of an institution's financial product activities must be directed towards economically distressed target markets.[4]

The seven core requirements for this compound certification are:

-

Legal Entity: The applicant must be a legal entity at the time of application.[1][2]

-

Primary Mission of Community Development: The organization's core purpose must be to promote community development.[1][2]

-

Financing Entity: The applicant must be a financing entity.[1][2]

-

Primarily Serve a Target Market: The organization must primarily serve one or more designated target markets.[1][2]

-

Provide Development Services: The institution must offer development services in conjunction with its financing activities.[1][2]

-

Maintain Accountability to a Target Market: The organization must be accountable to its defined target market.[1][2]

-

Non-Governmental Entity: The applicant must not be a government entity or controlled by one (with exceptions for tribal governments).[1][2]

The this compound Certification Process: A Methodological Workflow

The this compound certification process involves a detailed application submitted through the this compound Fund's Awards Management Information System (AMIS).[5] As of December 7, 2023, the this compound Fund has released a revised this compound Certification Application with a phased implementation for new and existing CDFIs.[6]

Experimental Protocol: this compound Certification Application

-

Account Creation: The applicant organization must first create an account in the this compound Fund's Awards Management Information System (AMIS).[5]

-

Transaction Level Report (TLR) Submission: New applicants are required to submit an abbreviated version of the Transaction Level Report (TLR). This report details the organization's origination activities for its most recently completed fiscal year and is used to assess compliance with target market benchmarks.[6]

-

Application Completion: The applicant completes the this compound Certification Application within AMIS, providing detailed information and supporting documentation for each of the seven certification requirements.[5]

-

Target Market Analysis: A critical component of the application is demonstrating that the organization directs at least 60% of both the number and dollar volume of its financial products to one or more eligible target markets.[4] The this compound Fund provides pre-approved methodologies for this assessment.[4]

-

Review and Decision: The this compound Fund's Office of Certification Policy and Evaluation reviews the submitted application and TLR data. The this compound Fund may request additional information or clarification during the review process. A final determination on certification is then made.

Below is a diagram illustrating the this compound certification workflow:

Regulation and Ongoing Compliance

Certified CDFIs are subject to ongoing regulation and compliance monitoring to ensure they continue to meet the certification requirements.[7] This is primarily accomplished through the submission of the Annual Certification and Data Collection Report (ACR).[7]

Experimental Protocol: Annual Compliance and Reporting

-

Annual Certification and Data Collection Report (ACR): All certified CDFIs must submit an ACR to the this compound Fund annually.[8] This report allows the this compound Fund to assess a this compound's ongoing compliance with certification guidelines and gathers data on the this compound industry.[7]

-

ACR Submission Timeline: For organizations certified under the revised application, the ACR is due within 180 days of their fiscal year-end.[7] Those certified under the previous application must submit the ACR within 90 days of their fiscal year-end until they are recertified under the new application.[7]

-

Transaction Level Report (TLR): As part of the revised certification policies, all certified CDFIs are required to submit a TLR annually with their ACR.[7]

-

Material Events Reporting: CDFIs that have received awards from the this compound Fund are required to submit a Material Events form within 30 days of the occurrence of a significant event that could affect their certification status.[9]

-

Regulatory Oversight for Depository Institutions: this compound banks and credit unions are also subject to oversight by their primary federal regulators, such as the Consumer Financial Protection Bureau (CFPB), the National Credit Union Administration (NCUA), the Federal Deposit Insurance Corporation (FDIC), and the Office of the Comptroller of the Currency (OCC).[10][11][12]

The following diagram illustrates the regulatory and compliance structure for CDFIs:

Quantitative Data on the this compound Industry

The this compound industry has experienced significant growth in recent years. The following tables summarize key quantitative data about the industry.

Table 1: Growth of the this compound Industry

| Metric | 2018 | May 2023 | Growth |

| Industry Assets | ~$150 Billion | > $450 Billion | ~200% |

| Number of Certified CDFIs | ~1,040 | ~1,460 | ~40% |

| Number of this compound Credit Unions | 290 (2019) | 529 | ~82% |

| Source: Federal Reserve, this compound Coalition[13][14] |

Table 2: Types of Certified CDFIs (as of September 2023)

| This compound Type | Percentage of Total |

| Loan Fund | 42% |

| Credit Union | 34% |

| Bank or Thrift | 13% |

| Depository Institution Holding Company | 10% |

| Venture Capital Fund | <1% |

| Source: An Introduction to the this compound Fund - OCC.gov[15] |

Regulatory Distinctions for Different this compound Types

While all CDFIs must adhere to the this compound Fund's certification and reporting requirements, their primary regulatory oversight can differ based on their institutional structure.

Table 3: Regulatory Oversight by this compound Type

| This compound Type | Primary Regulators | Key Characteristics |

| Community Development Banks & Thrifts | FDIC, OCC, Federal Reserve, State Banking Agencies | For-profit institutions with community representation on their boards. Deposits are FDIC-insured.[12] |

| Community Development Credit Unions | NCUA, State Regulators | Non-profit financial cooperatives owned by their members. Deposits are typically insured by the NCUA.[12] |

| Community Development Loan Funds | State laws where they operate; subject to third-party audits. Not federally regulated as depository institutions. | Typically non-profits providing financing and development services.[11] |

| Community Development Venture Capital Funds | State laws; not federally regulated as depository institutions. | For-profit or non-profit funds providing equity and debt-with-equity features.[11] |

It is important to note that the National Credit Union Administration (NCUA) and the this compound Fund have a partnership to streamline the this compound certification process for qualifying low-income designated credit unions (LICUs).[16] This initiative allows eligible credit unions to submit data to the NCUA for a preliminary qualification analysis before proceeding with the application to the this compound Fund.[16]

Conclusion

The certification and regulation of CDFIs in the United States is a multi-faceted process overseen by the this compound Fund, with additional layers of oversight for depository institutions from their primary federal regulators. The rigorous certification process ensures that these institutions maintain a primary mission of community development and primarily serve low-income and underserved communities. Ongoing compliance, primarily through the Annual Certification and Data Collection Report, ensures that certified CDFIs continue to adhere to these standards. The framework is designed to foster a robust and accountable network of financial institutions dedicated to promoting economic opportunity in distressed communities across the nation.

References

- 1. cdfifund.gov [cdfifund.gov]

- 2. This compound Certification | Community Development Financial Institutions Fund [cdfifund.gov]

- 3. Community Development Financial Institutions (CDFIs) | America's Credit Unions [americascreditunions.org]

- 4. cdfifund.gov [cdfifund.gov]

- 5. cdfifund.gov [cdfifund.gov]

- 6. This compound Certification | Community Development Financial Institutions Fund [cdfifund.gov]

- 7. This compound Certification | Community Development Financial Institutions Fund [cdfifund.gov]

- 8. Reminder: Annual Compliance, Certification and Reporting Obligations | Community Development Financial Institutions Fund [cdfifund.gov]

- 9. cdfifund.gov [cdfifund.gov]

- 10. Treasury reaffirms important regulatory exemptions for CDFIs | The Change Company this compound, LLC [thechangecompany.com]

- 11. mycnote.com [mycnote.com]

- 12. ofn.org [ofn.org]

- 13. Sizing the this compound Market: Understanding Industry Growth - FEDERAL RESERVE BANK of NEW YORK [newyorkfed.org]

- 14. This compound.org [this compound.org]

- 15. occ.treas.gov [occ.treas.gov]

- 16. reginfo.gov [reginfo.gov]

What is the role of the CDFI Fund in supporting community development?

An In-depth Technical Guide on the Role of the CDFI Fund in Supporting Community Development

Abstract

The Community Development Financial Institutions (this compound) Fund, a division of the U.S. Department of the Treasury, plays a pivotal role in fostering economic growth and opportunity in the nation's most distressed urban and rural communities.[1][2] Established by the Riegle Community Development and Regulatory Improvement Act of 1994, the this compound Fund's primary mission is to expand economic opportunity for underserved people and communities by supporting the growth and capacity of a national network of community development lenders, investors, and financial service providers.[3][4] This is achieved through a series of specialized programs that inject federal resources alongside private sector capital into mission-driven financial institutions known as Community Development Financial Institutions (CDFIs).[2][5] These institutions, in turn, provide essential financial products and services, such as mortgage financing, small business loans, and technical assistance, to populations and areas that lack access to mainstream finance.[3][6] This guide provides a technical overview of the this compound Fund's operational framework, its core programs, quantitative impact, and the methodologies used to evaluate its contributions to community development.

The this compound Fund Ecosystem and Operational Framework

The this compound Fund operates as a public-private partnership model designed to leverage federal investment to attract significantly larger amounts of private capital into low-income communities.[5][7] The central purpose of the enabling legislation, The Community Development Banking and Financial Institutions Act of 1994, was to create the Fund to promote economic revitalization by investing in and assisting CDFIs.[8]

A Community Development Financial Institution (this compound) is a specialized financial institution that has a primary mission of community development and provides financial products and services to underserved markets and populations.[5][6] To be eligible for many of the this compound Fund's programs, an organization must be certified as a this compound.[9] This certification is granted to a range of financial entities, including banks, credit unions, non-profit loan funds, and venture capital funds, that have demonstrated a commitment to serving economically distressed communities.[3][6] As of winter 2025, there were 1,432 Treasury-certified CDFIs.[1]

The operational framework involves the this compound Fund providing resources through competitive awards to certified CDFIs. These CDFIs then use this capital to finance affordable housing, small businesses, community facilities, and provide financial education, thereby creating jobs and revitalizing neighborhoods.[10]

Core Programs and Funding Mechanisms

The this compound Fund administers a suite of programs, each designed to address specific needs within distressed communities through different financial mechanisms.[1][11] Awards are typically granted through a competitive application process.[9]

-

This compound Program: This is the Fund's foundational program, providing two main types of awards.[3]

-

Financial Assistance (FA): Provides capital in the form of loans, grants, and equity investments that CDFIs can use for lending capital, loan loss reserves, or other operational needs.[1][12] FA awards require a dollar-for-dollar match with non-federal funds, effectively doubling the impact of the federal investment.[12]

-

Technical Assistance (TA): Offers grants to help certified and emerging CDFIs build their organizational capacity, which can include staff training, technology upgrades, or hiring consultants.[1][9]

-

-

New Markets Tax Credit (NMTC) Program: Authorized in 2000, this program is designed to stimulate private investment in low-income communities.[1] It provides tax credits to individual and corporate investors in exchange for making equity investments in certified Community Development Entities (CDEs), which then use those funds to invest in local businesses and revitalization projects.[1][13]

-

Capital Magnet Fund (CMF): Provides competitive grants to CDFIs and non-profit housing organizations to finance the development, preservation, and rehabilitation of affordable housing and related economic development activities.[1][11]

-

Bank Enterprise Award (BEA) Program: This program offers monetary awards to FDIC-insured depository institutions that demonstrably increase their investments in CDFIs or their lending and service activities in economically distressed communities.[9][11]

-

This compound Bond Guarantee Program: Authorized in 2010, this program empowers the Treasury Department to guarantee bonds issued by CDFIs.[1] This guarantee provides CDFIs with access to substantial long-term, fixed-rate capital that is often unavailable through other sources, enabling them to scale their lending and investment activities.[1][11]

-

Specialized Initiatives: The this compound Fund also manages targeted programs, including the Native American this compound Assistance (NACA) Program to support economic self-determination in Native Communities, the Small Dollar Loan (SDL) Program to provide alternatives to predatory lending, and the Healthy Food Financing Initiative (HFFI) to combat food deserts.[1][3][5][11]

Quantitative Data and Impact Analysis

The impact of the this compound Fund is tracked through extensive data collection, revealing significant financial leverage and community-level outcomes. The tables below summarize key quantitative data from recent fiscal years.

Table 1: this compound Fund Program Demand and Awards (Fiscal Year 2024) [14]

| Program | Funds Requested | Funds Awarded/Available |

|---|---|---|

| Bank Enterprise Award (BEA) Program | $101.5 million | $40.1 million |

| Capital Magnet Fund (CMF) | $1.1 billion | $246.4 million |

| This compound Bond Guarantee Program | $673.0 million | $498.0 million |

| This compound Program - Base (FA & TA) | $1.1 billion | $329.7 million |

| New Markets Tax Credit (NMTC) Program | $14.7 billion | $5.0 billion |

| Small Dollar Loan (SDL) Program | $33.5 million | $18.0 million |

| Native American this compound Assistance (NACA) | $65.1 million | $51.0 million |

Table 2: Reported Outcomes from this compound Program Awardees

| Outcome Metric | Fiscal Year 2022[7] | Fiscal Year 2024[12][15] |

|---|---|---|

| Total Loans & Investments Originated | > $38 billion | > $24 billion |

| Businesses Financed | > 100,000 | > 109,000 |

| Affordable Housing Units Financed | Not specified | > 45,000 |

Table 3: Investment Leverage Ratios for Select Programs

| Program | Leverage Ratio (Private to Federal) | Source |

|---|---|---|

| Capital Magnet Fund (CMF) | Nearly $30 for every $1 | [1] |

| New Markets Tax Credit (NMTC) Program | $8 for every $1 | [7] |

| General Programs | At least $8 for every $1 |[7] |

Methodologies for Programmatic Evaluation

The this compound Fund employs rigorous, multi-stage protocols to evaluate applicants for funding and to monitor the performance and impact of its awardees. These methodologies are designed to ensure that federal resources are allocated effectively and generate measurable community development outcomes.

Experimental Protocol: Base-Financial Assistance (FA) Application Evaluation

The evaluation process for the core this compound Program's Base-FA awards is a structured, five-step protocol designed to assess an applicant's financial health, operational capacity, and potential for community impact.[16]

-

Step 1: Eligibility Review: this compound Fund staff conduct an initial screening to ensure the application meets all statutory and regulatory requirements as outlined in the Notice of Funds Availability (NOFA).[16]

-

Step 2: Financial Analysis and Compliance Risk Evaluation: Using an internal Application Assessment Tool (AAT), the Fund assesses the applicant's financial safety and soundness.[16] This step produces composite scores for financial health and compliance risk. An applicant must receive a score of 1, 2, or 3 (on a 5-point scale) to advance.[16]

-

Step 3: Business Plan Review: External, non-federal reviewers with expertise in community development finance evaluate the applicant's business plan.[16] This review assesses the soundness of the applicant's strategy, its market analysis, and its projected community impact.

-

Step 4: Policy Objective Review: this compound Fund staff conduct a final review to measure the application against key policy objectives.[16] This includes evaluating the economic distress of the communities served, the opportunities created to alleviate that distress, and the extent of collaboration with community partners.[16]

-

Step 5: Award Amount Determination: Based on the outcomes of the preceding steps, this compound Fund staff determine the final award amount.[16]

Protocol for Performance and Impact Measurement

Evaluating the long-term community impact of CDFIs presents methodological challenges due to the diversity of institutions and the difficulty of attributing specific outcomes directly to a single intervention.[17] However, the this compound Fund utilizes a standardized data collection protocol to monitor performance.

-

Annual Certification and Data Collection Report (ACR): Certified CDFIs are required to submit an ACR to the Fund annually.[5] This report is the primary tool for ensuring awardees adhere to their mission and for tracking the deployment of capital.

-

Data Collection Metrics: The ACR collects a wide range of quantitative data. Financial performance is measured using metrics similar to those used for traditional banks, such as capital adequacy, asset quality, and earnings.[17] Social impact is primarily measured through outputs, including:

-

The number and dollar amount of loans closed.

-

The number of jobs created or retained.

-

The number of affordable housing units constructed or preserved.[17]

-

-

Challenges and Limitations: The industry recognizes that simply counting outputs does not fully capture long-term outcomes or systemic impact.[17] Issues such as a lack of standardized definitions for impact metrics and the high cost of sophisticated evaluation techniques remain significant challenges for many CDFIs.[17][18]

Logical Framework: The this compound Fund's Theory of Change

The underlying logic of the this compound Fund's intervention can be visualized as a signaling pathway or theory of change. This model illustrates how initial inputs are transformed into activities, outputs, and ultimately, the desired long-term community outcomes.

Conclusion

The this compound Fund serves as a critical catalyst for community development by strategically deploying federal resources to build the capacity and financial strength of a national network of CDFIs. Through a diverse portfolio of programs, it incentivizes private investment in economically distressed areas, leading to measurable outputs such as new businesses, jobs, and affordable housing. While challenges in measuring long-term, systemic impact remain, the Fund's rigorous evaluation protocols for grant selection and its standardized data collection on awardee performance provide a robust framework for ensuring accountability and effectiveness. The public-private partnership model championed by the this compound Fund continues to be a vital mechanism for fostering economic equity and opportunity in communities that have been historically underserved by traditional financial institutions.

References

- 1. This compound.org [this compound.org]

- 2. Home | Community Development Financial Institutions Fund [cdfifund.gov]

- 3. congress.gov [congress.gov]

- 4. About Us | Community Development Financial Institutions Fund [cdfifund.gov]

- 5. congress.gov [congress.gov]

- 6. elischolar.library.yale.edu [elischolar.library.yale.edu]

- 7. occ.gov [occ.gov]

- 8. This compound.org [this compound.org]

- 9. fdic.gov [fdic.gov]

- 10. nlihc.org [nlihc.org]

- 11. Programs | Community Development Financial Institutions Fund [cdfifund.gov]

- 12. This compound Program | Community Development Financial Institutions Fund [cdfifund.gov]

- 13. capitalimpact.org [capitalimpact.org]

- 14. cdfifund.gov [cdfifund.gov]

- 15. cuinsight.com [cuinsight.com]

- 16. cdfifund.gov [cdfifund.gov]

- 17. frbsf.org [frbsf.org]

- 18. carolinasmallbusiness.org [carolinasmallbusiness.org]

The Economic Multiplier: A Technical Guide to Understanding the Impact of Community Development Financial Institutions

For Immediate Release

[City, State] – [Date] – This technical guide delves into the theoretical frameworks that underpin the analysis of Community Development Financial Institutions (CDFIs) and their impact on local economies. Designed for researchers, scientists, and drug development professionals, this document provides a comprehensive overview of the methodologies used to quantify the economic and social returns of CDFI investments.

Executive Summary

Community Development Financial Institutions (CDFIs) are specialized financial entities that provide credit and financial services to underserved markets and populations. The growing recognition of their role in fostering economic equity and growth has led to an increased demand for rigorous methods to evaluate their impact. This whitepaper presents the core theoretical frameworks, experimental protocols for impact assessment, and quantitative data analysis techniques necessary for a thorough understanding of this compound effectiveness. Through a synthesis of existing literature and methodologies, this guide offers a robust toolkit for researchers and practitioners in the field of community development finance.

Theoretical Frameworks for this compound Impact

The impact of CDFIs on local economies can be understood through several key theoretical lenses. These frameworks provide the foundation for developing measurable hypotheses and designing effective evaluation strategies.

2.1 Capital Access Theory: This is the most direct framework for understanding this compound impact. It posits that by providing capital to individuals and businesses in areas where traditional financial institutions are absent, CDFIs fill a critical credit gap. This injection of capital leads to direct economic outputs such as business creation and expansion, job growth, and the development of affordable housing and community facilities.

2.2 Social Capital Theory: CDFIs do more than just provide financial capital; they are instrumental in building social capital within communities. By fostering trust, networks, and a sense of collective efficacy, CDFIs empower residents and entrepreneurs. This enhanced social fabric can lead to longer-term, more resilient economic development, as community members are better equipped to collaborate and advocate for their collective interests.

2.3 Community Development Theory: This broader framework views CDFIs as key actors in a holistic community development process. It suggests that the impact of CDFIs extends beyond immediate financial transactions to encompass improvements in the overall quality of life, including better housing, access to essential services, and increased civic participation. This theory emphasizes the interconnectedness of economic, social, and physical environments in creating thriving communities.

A visual representation of the interplay between these frameworks is provided below.

Methodologies for Impact Assessment

Evaluating the impact of CDFIs requires a multi-faceted approach that combines qualitative and quantitative methods. This section details the primary experimental protocols used in the field.

3.1 Quasi-Experimental Designs: Due to the ethical and practical challenges of randomly assigning access to capital, true experimental designs are rare in this compound evaluation. Instead, quasi-experimental methods are commonly employed. These include:

- Propensity Score Matching (PSM): This statistical technique is used to create a comparable control group of individuals or businesses that did not receive this compound financing but share similar observable characteristics with those who did.

- Difference-in-Differences (DiD): This method compares the change in outcomes over time between a treatment group (this compound borrowers) and a control group.

3.2 Surveys and Interviews: Direct data collection from this compound clients is a cornerstone of impact assessment.

-

Baseline and Follow-up Surveys: Surveys administered at the time of loan origination (baseline) and at subsequent intervals are crucial for tracking changes in key outcome indicators. A sample survey instrument is detailed in the "Experimental Protocols" section.

-

In-depth Interviews and Case Studies: Qualitative methods provide rich, nuanced insights into the mechanisms through which this compound financing creates impact.

3.3 Econometric Modeling: Statistical models are used to isolate the effect of this compound lending on local economic indicators while controlling for other factors. Common approaches include:

- Regression Analysis: This can be used to examine the relationship between the volume of this compound lending in a geographic area and changes in metrics like employment rates, poverty levels, and new business formation.

- Data Envelopment Analysis (DEA): This method is used to assess the relative efficiency of CDFIs in converting their resources into desired outputs and outcomes.[1]

- Logistic Regression: This can be used to predict the likelihood of institutional failure, comparing CDFIs to mainstream financial institutions.[1]

3.4 Social Return on Investment (SROI): SROI is a framework for measuring and communicating the broader concept of value created by an organization. It seeks to monetize social and environmental outcomes to calculate a ratio of benefits to costs.[2]

Experimental Protocols

This section provides detailed methodologies for key experiments cited in the literature.

4.1 Protocol for a Quasi-Experimental Evaluation of Job Creation

-

Objective: To estimate the net number of jobs created by businesses that receive financing from a this compound.

-

Design: A quasi-experimental design using propensity score matching.

-

Procedure:

-

Data Collection: Collect baseline data from all loan applicants, including firm size, industry, revenue, and owner demographics.

-

Treatment and Control Groups: The treatment group consists of businesses that received a loan. The control group is selected from the pool of rejected applicants using propensity score matching to identify a comparable group.

-

Follow-up Data Collection: After a predetermined period (e.g., two years), collect follow-up data on the number of full-time and part-time employees from both groups through surveys and analysis of payroll records.

-

Analysis: Use a difference-in-differences approach to compare the change in employment between the treatment and control groups.

-

4.2 Protocol for a Social Return on Investment (SROI) Analysis

-

Objective: To calculate the social and economic value created for every dollar invested in a this compound's small business lending program.

-

Design: A retrospective SROI analysis.

-

Procedure:

-

Stakeholder Identification: Identify all key stakeholders, including borrowers, employees, the local government, and the broader community.

-

Impact Mapping (Theory of Change): For each stakeholder group, map the inputs, activities, outputs, and outcomes resulting from the this compound's lending.

-

Outcome Valuation: Assign a financial proxy to each outcome. For example, the value of a new job created can be estimated based on the average salary and benefits, and the reduced reliance on government assistance.

-

Establishing Impact: Adjust the value of outcomes to account for what would have happened anyway (deadweight), the contribution of others (attribution), and the displacement of other economic activity.

-

Calculating the SROI Ratio: The net present value of the benefits is divided by the net present value of the investment.

-

Data Presentation: Key Performance Indicators

The following tables summarize common output and outcome metrics tracked by CDFIs, along with illustrative data from a hypothetical this compound small business lending program.

Table 1: Common this compound Output and Outcome Metrics

| Metric Type | Category | Indicator |

| Output | Lending Activity | Number of loans disbursed |

| Dollar value of loans disbursed | ||

| Client Demographics | % of loans to minority-owned businesses | |

| % of loans to women-owned businesses | ||

| % of loans in low-to-moderate income (LMI) census tracts | ||

| Outcome | Business Growth | Change in annual revenue |

| Change in number of employees (FTEs) | ||

| Job Quality | Change in average wages and benefits | |

| Borrower Financial Health | Change in credit score | |

| Change in personal assets |

Table 2: Illustrative Impact Data for a this compound Small Business Lending Program (Year 1 vs. Year 3)

| Indicator | Year 1 (Baseline) | Year 3 (Follow-up) | Change |

| Number of Businesses Supported | 50 | 50 | N/A |

| Average Annual Revenue | $150,000 | $225,000 | +$75,000 |

| Total Full-Time Employees | 125 | 175 | +50 |

| Average Hourly Wage | $18.50 | $22.00 | +$3.50 |

| % of Businesses Offering Health Insurance | 30% | 55% | +25% |

| Average Borrower Credit Score | 620 | 680 | +60 |

Conclusion

The theoretical frameworks and methodologies outlined in this guide provide a robust foundation for understanding and quantifying the impact of CDFIs on local economies. By employing quasi-experimental designs, rigorous data collection through surveys, sophisticated econometric modeling, and comprehensive valuation techniques like SROI, researchers and practitioners can generate credible evidence of the multifaceted value that CDFIs create. Continued refinement of these methods will be essential for strengthening the evidence base and informing policy and investment decisions in the field of community development finance.

References

The Ascent of Community Development Financial Institutions: A Deep Dive into an Evolving Industry

An In-depth Technical Guide for Researchers and Drug Development Professionals

The Community Development Financial Institutions (CDFI) industry has emerged as a critical component of the financial landscape, dedicated to serving low-income and underserved communities often overlooked by traditional banking institutions. This technical guide provides a comprehensive overview of the evolution and growth of the this compound industry, presenting key data, methodologies for impact assessment, and a visualization of the capital flow that fuels this vital sector.

A Legacy of Financial Inclusion: The Historical Evolution of the this compound Industry

The roots of the this compound industry can be traced back to the Civil Rights Movement and the War on Poverty in the 1960s, which highlighted the stark economic disparities and lack of access to capital in many American communities. Early predecessors to CDFIs included minority-owned banks and community development corporations that sought to provide financial services and support to these marginalized areas.

A pivotal moment in the industry's history was the establishment of ShoreBank in Chicago in 1973, widely considered the nation's first this compound.[1] This pioneering institution demonstrated the viability of a "double bottom line" approach, proving that investments in underserved communities could be both socially impactful and financially sustainable.

The 1980s saw the emergence of a more formalized this compound movement, with the establishment of numerous loan funds and the growth of a national network of practitioners. However, it was the enactment of the Riegle Community Development and Regulatory Improvement Act of 1994 that truly catalyzed the industry's growth. This landmark legislation created the this compound Fund, a U.S. Treasury Department entity tasked with providing financial and technical assistance to certified CDFIs. The this compound Fund has been instrumental in professionalizing the industry, setting standards for certification, and attracting private sector investment.

Quantifying Growth: A Look at the Numbers

The this compound industry has experienced remarkable growth since the inception of the this compound Fund. The number of certified institutions, their assets under management, and their lending activities have all seen a significant upward trajectory, particularly in recent years.

Table 1: Growth in the Number of Certified CDFIs (1997-2024)

| Year | Number of Certified CDFIs |

| 1997 | 196 |

| 2013 | 809 |

| 2020 | 1,146 |

| 2024 | 1,426 |

Source: this compound Fund[2][3]

Table 2: Growth of this compound Assets Under Management (2018-2023)

| Year | Total Assets |

| 2018 | ~$150 Billion |

| 2022 | >$450 Billion |

| 2023 | >$400 Billion |

Source: Federal Reserve Bank of New York, this compound Coalition[4][5][6][7][8]

This substantial increase in assets has been largely driven by the growth of this compound credit unions and banks.[1][6]

Table 3: this compound Lending Volume (2018-2022)

| Year | Loan Origination Volume |

| 2018 | $29 Billion |

| 2022 | $67 Billion |

Source: Federal Reserve Bank of New York[4][5][9]

This surge in lending demonstrates the increasing role of CDFIs in providing critical financing for small businesses, affordable housing, and community facilities in underserved areas.

Methodologies for Assessing Impact: A Guide to Experimental Protocols

Evaluating the true impact of CDFIs on community development is a complex endeavor. While traditional financial metrics are important, the industry's "double bottom line" necessitates a more holistic approach to assessment. Researchers and practitioners have employed a variety of methodologies to understand the social and economic returns of this compound investments. Due to the nature of community-based interventions, classic randomized controlled trials (RCTs) are often challenging to implement. However, several robust quasi-experimental and qualitative methods have been utilized.

Quasi-Experimental Design: Regression Discontinuity Analysis

-

Objective: To assess the causal impact of receiving a this compound loan or investment by comparing outcomes for applicants just above and below a specific funding cutoff score.

-

Methodology:

-

Data Collection: Gather data on all loan/investment applicants, including their application scores and relevant outcome metrics (e.g., business revenue growth, job creation, housing stability).

-

Identify the Cutoff: Determine the minimum score required to receive funding. This creates a natural "discontinuity" in the data.

-

Statistical Analysis: Employ regression analysis to compare the outcomes of applicants who scored just above the cutoff (and received funding) with those who scored just below (and did not).

-

Assumption: The core assumption is that applicants on either side of the cutoff are, on average, very similar in all other respects, making the receipt of funding the primary variable of interest.

-

-

Key Insight: This method allows for a more rigorous estimation of the "treatment effect" of this compound financing, moving beyond simple correlations.

Qualitative Methodology: In-depth Borrower Interviews

-

Objective: To gain a nuanced understanding of the impact of this compound financing on the lives and businesses of borrowers, beyond what can be captured in quantitative data.

-

Methodology:

-

Sampling: Select a diverse sample of this compound borrowers representing different loan types, business sectors, and demographic backgrounds.

-

Interview Protocol: Develop a semi-structured interview guide to explore topics such as:

-

The borrower's financial situation before and after receiving the loan.

-

The role of the this compound's technical assistance and relationship management.

-

The impact of the financing on business growth, job creation, and community engagement.

-

Challenges and successes experienced throughout the loan period.

-

-

Data Analysis: Transcribe and code the interviews to identify recurring themes, patterns, and illustrative case studies.

-

-

Key Insight: This approach provides rich, narrative data that can illuminate the mechanisms through which CDFIs create impact and can help in refining program design and delivery.

Logic Model Framework

-

Objective: To visually represent the theory of change behind a this compound's interventions, linking inputs and activities to outputs, outcomes, and long-term impact.

-

Methodology:

-

Define Components:

-

Inputs: The resources a this compound utilizes (e.g., capital, staff expertise).

-

Activities: The specific actions the this compound takes (e.g., underwriting loans, providing technical assistance).

-

Outputs: The direct products of the activities (e.g., number of loans disbursed, hours of counseling provided).

-

Outcomes: The short- and medium-term changes that result from the outputs (e.g., increased business revenue, improved credit scores).

-

Impact: The long-term, systemic change the this compound aims to achieve (e.g., revitalized local economy, increased community wealth).

-

-

Map the Connections: Diagram the logical flow from inputs to impact, illustrating the causal relationships between each component.

-

-

Key Insight: The logic model serves as a valuable tool for program planning, monitoring, and evaluation, ensuring that a this compound's activities are aligned with its intended mission and goals.

Visualizing the Engine of Change: Signaling Pathways and Capital Flow

The growth and impact of the this compound industry are driven by a dynamic flow of capital from a diverse range of sources. This capital is then strategically deployed to meet the needs of underserved communities. The following diagrams, created using the DOT language for Graphviz, illustrate these critical pathways.

References

- 1. Research Design Issues for Measuring this compound Performance and Impact [ebrary.net]

- 2. ofn.org [ofn.org]

- 3. academic.oup.com [academic.oup.com]

- 4. frbsf.org [frbsf.org]

- 5. ecomap.tech [ecomap.tech]

- 6. Mapping the Native this compound Industry: Insights from a New Survey | Federal Reserve Bank of Minneapolis [minneapolisfed.org]

- 7. cdfifund.gov [cdfifund.gov]

- 8. This compound.org [this compound.org]

- 9. datakind.org [datakind.org]

The Critical Role of Community Development Financial Institutions in Advancing Financial Inclusion in Underserved Communities: An In-depth Technical Guide

Abstract: Community Development Financial Institutions (CDFIs) have emerged as pivotal players in fostering economic equity and financial inclusion across the United States. Operating in areas often underserved by traditional banking institutions, CDFIs provide essential financial products, services, and development assistance to low-income and marginalized communities. This technical guide provides a comprehensive analysis of the operational frameworks of CDFIs, the diverse array of financial instruments they employ, and their quantifiable impact on underserved populations. It further details the methodological approaches for evaluating the efficacy of CDFI interventions, offering a robust framework for researchers, policymakers, and professionals in the field of economic development. Through a synthesis of quantitative data, detailed experimental protocols, and visual representations of key processes, this paper illuminates the integral role of CDFIs in building a more inclusive and equitable financial landscape.

Introduction: The Imperative of Financial Inclusion

Financial inclusion, the concept of making financial products and services accessible and affordable to all individuals and businesses, is a cornerstone of economic and social well-being.[1] However, significant disparities in access to capital and banking services persist, particularly in low-income urban and rural communities, as well as for minority and women-led enterprises. These gaps are often the result of historical practices like redlining and market failures where mainstream financial institutions perceive lending in these areas as too risky or unprofitable.[2]

Community Development Financial Institutions (CDFIs) are specialized financial entities that work to bridge these divides.[2][3] Certified by the U.S. Department of the Treasury's this compound Fund, these institutions are mission-driven, with a primary goal of promoting community development and providing financial services in underserved markets.[4][5] This guide explores the multifaceted role of CDFIs in promoting financial inclusion, their operational models, the impact they generate, and the methodologies used to assess their effectiveness.

The this compound Ecosystem: Operational Models and Financial Products

CDFIs are not a monolithic entity; they encompass a diverse range of institutions, each with a unique structure and focus. This diversity allows them to tailor their products and services to the specific needs of their target communities.

The primary types of CDFIs include:

-

Community Development Banks: These are for-profit, regulated institutions that provide a wide range of banking services to underserved communities, including checking and savings accounts, as well as commercial and consumer loans.

-

Community Development Credit Unions (CDCUs): As nonprofit, member-owned cooperatives, CDCUs offer affordable financial services to their members, who are typically residents of low-income communities.

-

Community Development Loan Funds (CDLFs): These are typically nonprofit organizations that provide financing for projects such as affordable housing, small businesses, and community facilities. They often offer more flexible lending terms than traditional banks.[6]

-

Community Development Venture Capital (CDVC) Funds: CDVC funds provide equity and debt-with-equity features to small and medium-sized businesses in underserved markets, aiming to generate both financial returns and social impact.[7]

These institutions offer a variety of financial products and services designed to meet the unique needs of their clients, including:

-

Microloans: Small loans provided to entrepreneurs and small business owners who may not qualify for traditional financing.

-

Affordable Housing Loans: Financing for the development, rehabilitation, and purchase of affordable housing units.

-

Consumer Loans: Fairly priced loans for individuals for purposes such as car purchases, debt consolidation, or emergency needs.

-

Financial Education and Counseling: Many CDFIs provide technical assistance, including financial literacy training, business planning support, and credit counseling, to empower their clients to make sound financial decisions.[1][3][6]

Data Presentation: Quantifying the Impact of CDFIs

The impact of CDFIs on underserved communities is substantial and can be quantified through various metrics. The following tables summarize key quantitative data from recent years, showcasing the scale and scope of this compound activities.

| Metric | FY 2021 | FY 2023 | Source |

| Total Loans/Investments Originated | $38.75 billion | $57.74 billion | [6][8] |

| Number of Loans/Investments Originated | 4,073,971 | 2,036,248 | [6][8] |

| Financing for Businesses | - | $10.7 billion (OFN Members, 2022) | [4] |

| Affordable Housing Units Financed | - | Over 33,613 (FY 2018) | [9] |

| Consumer Loans Originated | - | 207,657 totaling $3.5 billion (FY 2018) | [9] |

| Individuals Receiving Financial Literacy Training | - | 343,471 (FY 2018) | [9] |

| Table 1: Annual Lending and Investment Activity of this compound Program Award Recipients. |

| Cumulative Impact (OFN Members through 2023) | Value | Source |

| Total Financing Provided | $124 billion | |

| Jobs Created or Maintained | 3.4 million | |

| Businesses and Microenterprises Created or Expanded | 1 million | |

| Housing Units Supported | 3 million | |

| Community Facilities Financed | 15,000 | |

| Table 2: Cumulative Impact of Opportunity Finance Network (OFN) Member CDFIs. |

Experimental Protocols: Methodologies for Impact Assessment

Evaluating the true impact of CDFIs requires rigorous and multifaceted methodological approaches. A primary framework utilized in the field is the Logic Model , which provides a systematic and visual way to articulate the relationships between a program's resources, activities, outputs, outcomes, and long-term impact.

The Logic Model Framework

A logic model serves as a roadmap, outlining the theory of change behind a this compound's intervention. It typically consists of the following components:

-

Inputs: The resources invested in a program, such as funding, staff, and partnerships.

-

Activities: The specific actions and interventions undertaken by the this compound, such as providing loans, offering technical assistance, or conducting financial literacy workshops.

-

Outputs: The direct and measurable products of the activities, such as the number of loans disbursed, the number of individuals trained, or the number of housing units built.

-

Outcomes: The short-term and intermediate-term changes that result from the program's activities, such as improved credit scores, increased business revenue, or enhanced housing stability.

-

Impact: The long-term, systemic changes in the community, such as reduced poverty rates, increased wealth accumulation, or greater economic resilience.

Caption: A simplified logic model illustrating the causal pathway of this compound interventions.

Case Study: Evaluation of a Small Business Lending Program

Objective: To assess the impact of a this compound's small business lending program on the growth and sustainability of minority-owned businesses in a specific urban area.

Methodology:

-

Baseline Data Collection: Prior to loan disbursement, collect baseline data from all loan applicants, including business revenue, number of employees, owner's credit score, and self-reported measures of business confidence.

-

Comparison Group: To the extent ethically and practically feasible, establish a comparison group of businesses that applied for but did not receive loans (e.g., due to being outside the target geographic area or not meeting minimal readiness criteria). This allows for a quasi-experimental design.

-

Longitudinal Data Collection: Collect follow-up data from both the loan recipients (treatment group) and the comparison group at regular intervals (e.g., 12, 24, and 36 months post-loan disbursement). Data collection methods can include surveys, analysis of financial statements, and in-depth qualitative interviews.

-

Key Performance Indicators (KPIs):

-

Quantitative:

-

Change in annual business revenue.

-

Net job creation.

-

Change in business owner's personal credit score.

-

Loan repayment rate.

-

-

Qualitative:

-

Business owner's perceived impact of the loan on their business operations and personal financial stability.

-

Challenges and opportunities encountered post-financing.

-

Satisfaction with the this compound's technical assistance.

-

-

-

Data Analysis: Employ statistical methods to compare the outcomes of the treatment group with the comparison group, controlling for baseline characteristics. Qualitative data from interviews should be coded and analyzed for recurring themes to provide context to the quantitative findings.

Caption: Workflow for evaluating the impact of a this compound small business lending program.

Challenges and the Future of CDFIs

Despite their proven success, CDFIs face several challenges that can limit their reach and impact. These include:

-

Limited Access to Capital: CDFIs often have less access to affordable, long-term capital compared to traditional financial institutions.[10]

-

Regulatory Burdens: Navigating complex regulatory requirements can increase operational costs and divert resources from their core mission.[10]

-

Lack of Awareness: Many potential clients in underserved communities are unaware of the services that CDFIs offer.[10]

-

Data Collection and Impact Measurement: While crucial for demonstrating effectiveness, rigorous data collection and impact evaluation can be resource-intensive for smaller CDFIs.

The future of financial inclusion is intrinsically linked to the continued growth and evolution of CDFIs.[10] Addressing the challenges they face will require a multi-pronged approach:

-

Increased and Diversified Funding: Expanding access to a mix of public and private capital, including grants, low-cost loans, and equity investments, is essential for scaling this compound operations.

-

Technological Adoption: Leveraging financial technology (fintech) can enhance operational efficiency, expand outreach, and improve the delivery of financial services.[8]

-

Policy Advocacy: Advocating for supportive public policies, such as a robust and well-funded this compound Fund, is critical to creating an enabling environment for their work.

-

Collaboration and Partnerships: Strengthening partnerships between CDFIs, traditional financial institutions, philanthropic foundations, and community-based organizations can amplify their collective impact.[1]

Caption: The interconnected relationships within the this compound ecosystem.

Conclusion

Community Development Financial Institutions are indispensable actors in the effort to create a more inclusive and equitable financial system. By providing capital, credit, and development services to communities that have been historically and systematically excluded, CDFIs generate a powerful ripple effect of economic opportunity, job creation, and wealth building. The quantitative data and evaluation methodologies presented in this guide underscore the significant and measurable impact of their work. As the economic landscape continues to evolve, supporting and scaling the this compound industry will be paramount to ensuring that all individuals and communities have the opportunity to participate in and benefit from a vibrant and prosperous economy.

References

- 1. quatt.com [quatt.com]

- 2. datakind.org [datakind.org]

- 3. ofn-drupal-pub.s3.amazonaws.com [ofn-drupal-pub.s3.amazonaws.com]

- 4. ofn.org [ofn.org]

- 5. cdfifund.gov [cdfifund.gov]

- 6. tandfonline.com [tandfonline.com]

- 7. Research & Data | Community Development Financial Institutions Fund [cdfifund.gov]

- 8. frbsf.org [frbsf.org]

- 9. This compound.org [this compound.org]

- 10. Experimental Methods for Impact Evaluation of this compound Product Lines [ebrary.net]

A Technical Guide to the Geographical Distribution of Community Development Financial Institutions (CDFIs) in the United States

For Researchers, Scientists, and Drug Development Professionals

This technical guide provides an in-depth analysis of the geographical distribution of Community Development Financial Institutions (CDFIs) across the United States. It is designed to offer researchers, scientists, and drug development professionals a comprehensive understanding of the landscape of these crucial financial entities. This guide summarizes quantitative data, details experimental protocols for geographical analysis, and provides visual representations of key CDFI processes and frameworks.

Quantitative Data on this compound Distribution

The following tables present a summary of the geographical distribution of CDFIs, offering insights into their state-by-state presence and the urban versus rural landscape.

Table 1: Distribution of Certified CDFIs by State and Territory

This table provides a count of certified CDFIs in each U.S. state and territory. The data has been compiled from the official list of Certified Community Development Financial Institutions provided by the this compound Fund.[1][2][3][4]

| State/Territory | Number of Certified CDFIs |

| Alabama | 15 |

| Alaska | 7 |

| Arizona | 20 |

| Arkansas | 14 |

| California | 108 |

| Colorado | 21 |

| Connecticut | 16 |

| Delaware | 5 |

| District of Columbia | 22 |

| Florida | 36 |

| Georgia | 29 |

| Hawaii | 6 |

| Idaho | 8 |

| Illinois | 56 |

| Indiana | 16 |

| Iowa | 13 |

| Kansas | 12 |

| Kentucky | 19 |

| Louisiana | 28 |

| Maine | 13 |

| Maryland | 23 |

| Massachusetts | 40 |

| Michigan | 32 |

| Minnesota | 38 |

| Mississippi | 31 |

| Missouri | 23 |

| Montana | 12 |

| Nebraska | 10 |

| Nevada | 6 |

| New Hampshire | 7 |

| New Jersey | 25 |

| New Mexico | 17 |

| New York | 92 |

| North Carolina | 38 |

| North Dakota | 6 |

| Ohio | 35 |

| Oklahoma | 11 |

| Oregon | 19 |

| Pennsylvania | 63 |

| Puerto Rico | 11 |

| Rhode Island | 6 |